This year, the Taskforce on Nature-related Financial Disclosures (TNFD) engaged us to support their global data strategy, and create a robust set of principles for nature data. These principles are designed to help shift financial flows towards nature-positive investments, by enabling the adoption of common, harmonised data sharing criteria.

What does good nature data look like?

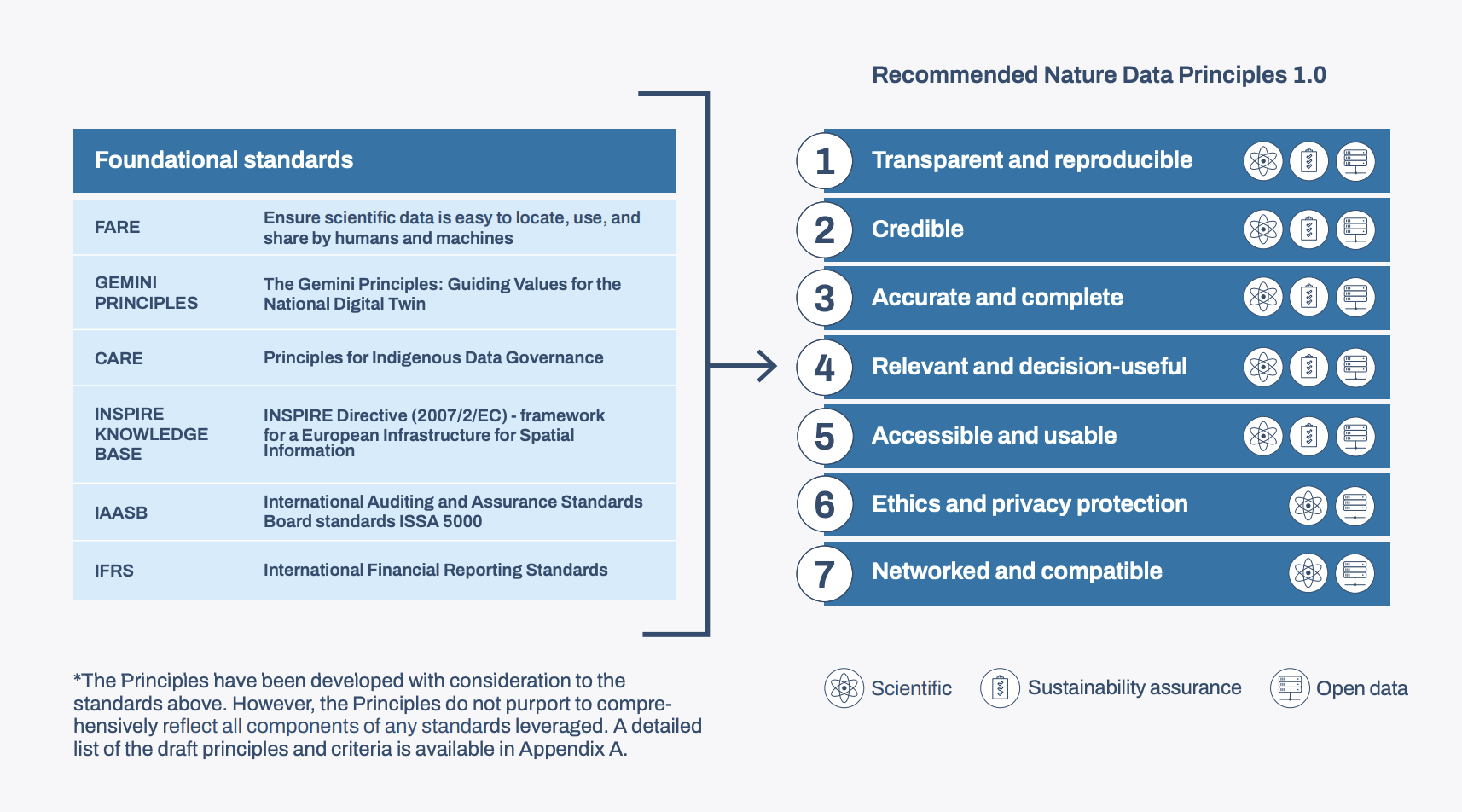

Working across multidisciplinary stakeholder teams, we identified seven key principles for high-quality nature datasets, acknowledging that nature data should be:

- Transparent and reproducible

- Credible

- Accurate and complete

- Relevant and decision-useful

- Accessible and usable

- Legal, ethical, privacy protecting

- Networked and compatible

Our Process

TNFD provided a roadmap of use cases, which we used as a foundation to work from. From this, our user-needs led approach helped define who the data users were as we developed a set of recommendations and principles that could lay the groundwork for nature data that supports financial decision-making.

“The Taskforce is very clear that its focus and contribution is on addressing use cases specific to corporations and financial institutions”

TNFD: A roadmap for upgrading market access to decision-useful nature-related data

Findings from the pilot testing of proposed nature data principles:

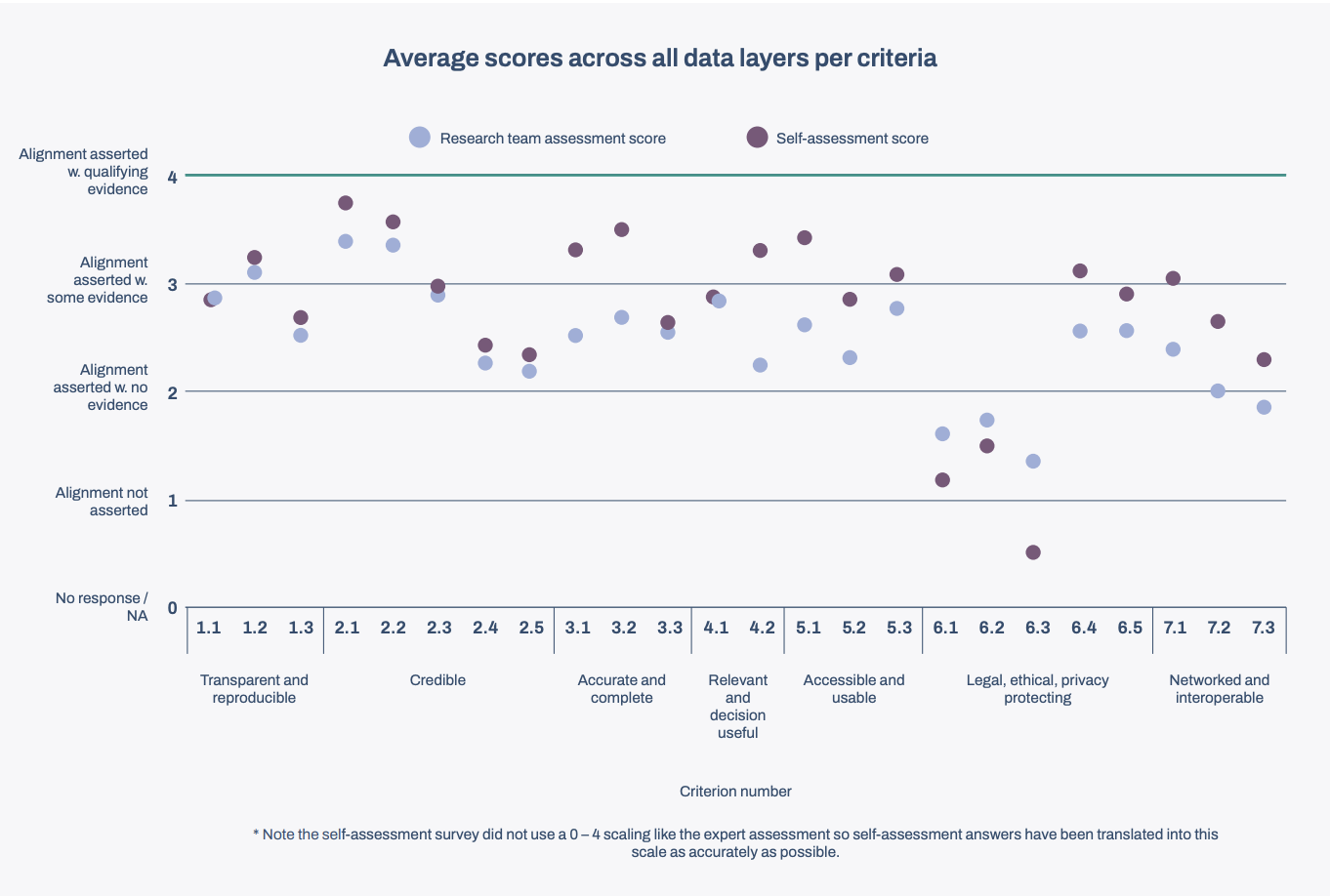

After evaluating 40 existing datasets against these principles, we confirmed that none fully met the standards required for global reporting or investment use. This exposed a critical gap for the financial sector: the absence of reliable, comparable, and standardised nature data needed to direct capital toward nature-positive outcomes.

“We tested 40 datasets against robust criteria for decision-useful nature data and found that none of them fully met the principles required for global reporting and investment needs.” Lewis Just, Lead Researcher

Understanding the barriers of nature-based data

A key reason for this gap lies in the complexity of nature data. Unlike carbon, which can be measured through a single metric such as tonnes of CO₂, nature spans many interconnected systems including water, soil, species, forests, and many more. Each uses different metrics, standards, and methods of measurement, making it extremely difficult to compare results across regions, sectors, or reporting frameworks.

Without harmonisation, financial institutions face a fragmented landscape where nature-related risks are hard to identify or value, and progress toward biodiversity goals is difficult to measure.

IB1’s approach brings structure and clarity to this complexity: developing guiding principles to support better quality, comparable, and decision-ready nature data that can help direct financial flows toward positive environmental outcomes.

Nature loss isn’t just an environmental issue, it’s an economic one

“Reducing nature data barriers is key to enabling effective nature-related reporting and accelerating action to halt and reverse nature loss.” (TNFD)

The impact of nature-related financial risk is widespread and financial institutions currently lack the data needed to measure and manage their nature-related financial risks. For instance, UK Banks could avoid potential losses of 4–5 % of loan-book value if they’re able to anticipate and price risks more accurately. For governments, making nature risk visible could help to avert $2.7 trillion annual GDP loss by 2030.

To unlock the power of nature data and positively shift financial investment, we need better access to high-quality, trustworthy nature data. But access alone isn’t enough, how that data is shared and governed is equally important.

Balancing openness with responsible governance

At first glance, it seems there’s a simple solution: make all nature data open and accessible, right? Unfortunately, it’s not that simple. And, in fact, not all data should be open.

For instance, sharing the precise locations of endangered species could make them more vulnerable to poaching. For example, GPS tracking data intended to help conserve rhinos could be exploited by poachers to locate the animals. Similarly, satellite-derived coral reef maps — created to support conservation — could be misused by developers and industrial fishing fleets to identify and exploit those same ecosystems.

That’s why responsible governance is crucial. Data providers must retain control and ownership over their datasets to prevent misuse and ensure that data serves its intended purpose: protecting and restoring nature.

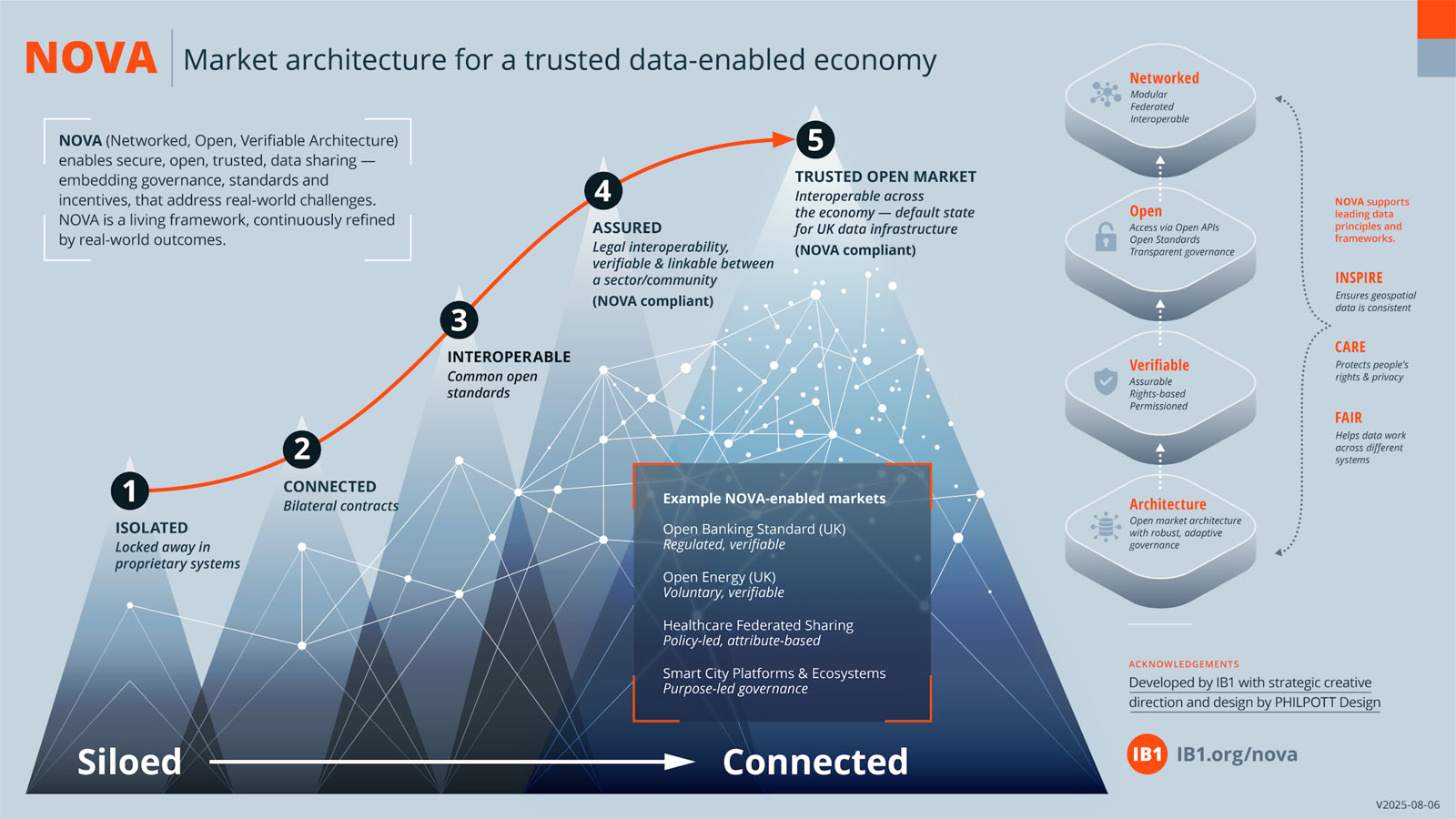

NOVA (Networked, Open, Verifiable Architecture)

Our NOVA principles were developed to guide us to outcomes that are interoperable, scalable, and aligned with existing standards, ensuring that data can be shared and used responsibly.

Applied through the lens of nature data, this means that sensitive information, such as species locations, is only accessible to those granted explicit permission, safeguarding wildlife while still enabling actionable insights for conservation and investment.

COP30 Brazil

IB1’s principles and recommendations for this project were formed to help TNFD understand what good nature data looks like, so that financial flows can shift towards investments that help, not harm, the planet.

With COP30 in Brazil now underway, the spotlight turns to a country that holds some of the world’s richest biodiversity and largest nature datasets. At its launch event in São Paulo on Thursday, November 6th, TNFD published its recommendations for upgrading the nature data value chain for market participants. This included a blueprint to govern, launch, operate and finance a Nature Data Public Facility (NDPF).