Join Perseus today

Executive Summary

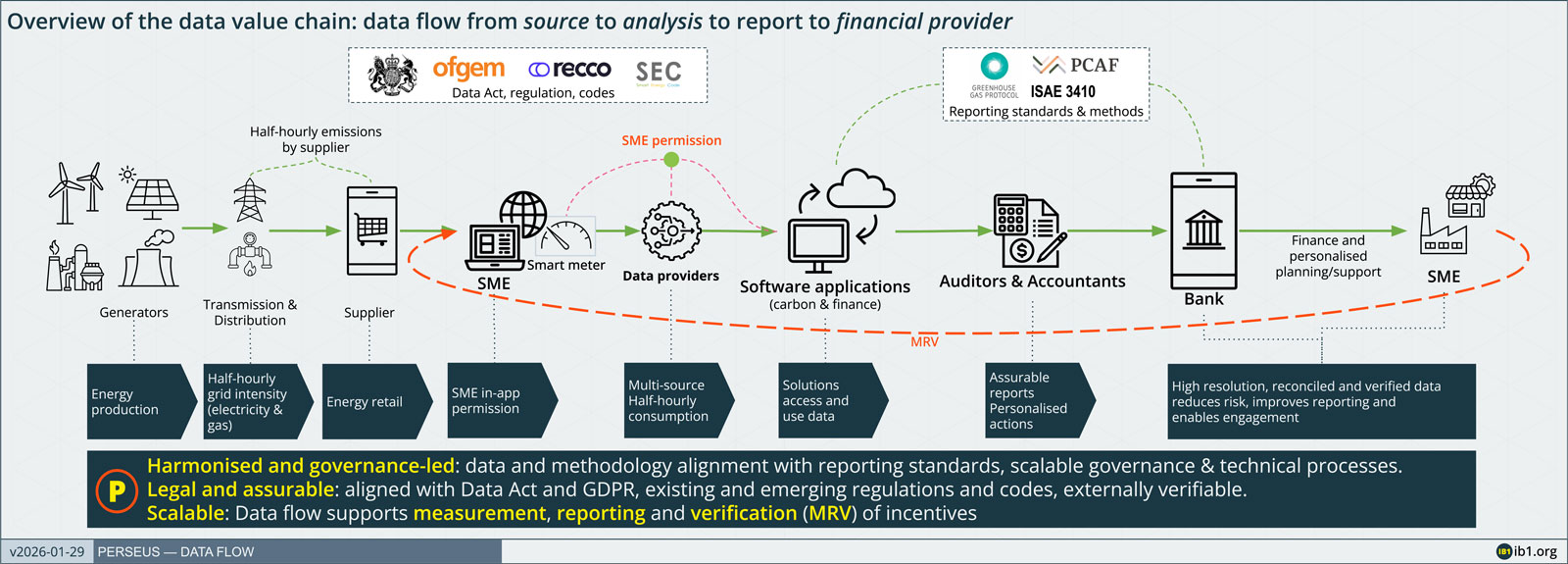

Perseus made huge progress in 2025. It can now support financial incentives that meet Small and Medium Enterprise (SME) needs where they are, and how they wish to invest: whether they are funding net zero, energy efficiencies, or transition planning.

This evolution enables banks and lenders to reward SMEs whether they are funding via cash flow, loans, credit or other incentives. To help stimulate economic growth, Perseus-enabled incentives can radically reduce reporting costs, unlocking the deployment of capital for energy efficiency, decreasing carbon intensity, and stimulating new financial innovation.

It unlocks assurable smart data to flow at scale, automating reporting in a manner that de-risks SME financing for financial service providers. This enables comparable, personalised and credible insights to ‘go to where the customer is’ by embedding directly into mainstream accounting systems, carbon management and analysis tools, and financial products and services.

As a national programme, Perseus provides the data plumbing for impact, with trusted governance and oversight. It helps embed sustainability into the financial system rather than treating ‘green’ as an edge-case. As a market-led, pragmatic, low-cost and low-friction approach, Perseus stimulates a sustainable future.

“As a leading smart data initiative, Perseus is developing guardrails for assurable data to support finance and supply chain decisions towards a sustainable economy.”

Hannah Gilbert, Director of Sustainability, British Business Bank

Expanding from ‘financing green’ to embedded sustainable finance

Members have led the evolution of Perseus from financing green (supporting individual sustainable projects) to sustainable finance (embedding trusted emissions data directly into accounting). This is an ambitious, market-wide transformation of the financial system. This is especially relevant given that 60% of SME lending now comes from sources other than the main high street banks.

“Lloyds is working with Perseus to develop and automate common data sharing standards for sustainability reporting. This will help us deliver assurable data, improving risk management and supporting better products and services for our SME customers, to build both economic and environmental resilience.”

Neil Oliver, Deputy Head of Environmental Sustainability, Portfolio Analytics, Commercial Banking at Lloyds Banking Group

Perseus 2025 outcomes

- Scope expansion

- Expanding the total addressable market from ‘financing green’ to embedded ‘sustainable finance’, and enable Perseus to be applied to the whole SME market: including debt financing, debit, credit and savings accounts

- Engaging with both commercial real estate (e.g. sublet offices) and national smart meter roll out energy data sources for both electricity and gas

- Extending energy coverage from electricity (Scope 2) to include gas (Scope 1) which covers an estimated 70% of market use cases

- Initiating Project Orion to support the harmonisation of SME net zero reporting across applications (e.g. ratings, supply chains) using Perseus as its foundation

“Perseus’ work to improve data infrastructure and automate emissions reporting has the potential to make sustainable finance more accessible to SMEs by providing them with high-quality data on their business, all whilst easing their data-processing workload. Perseus aims to help SMEs unlock the benefits that emissions tracking can bring to business, and we look forward to seeing the impact that Perseus’ work may have.”

Dana Clouston, Head of Sustainable Finance & Lending Optimisation, Barclays Business Bank

- Industry engagement

- Validating core user needs across SMEs, banks, application vendors, and energy data providers

- Exploring implementations with Sage, Quantaco, Tese, VoltView, Lloyds, and Barclays. Continue to advance integration with energy data providers Perse, Demand Logic and Smart DCC. (e.g. Sage Earth is rolling out to hundreds of thousands of UK SMEs with a Perseus-enabled product)

- Demonstrating alignment of the Perseus voluntary Scheme with the UK Data (Use and Access) Act 2025 as a flagship cross-sector Smart Data initiative

- Collaborating with XBRL on embedding in reporting, making Perseus ‘plug and play’ for regulators, accountants and other financial systems

- Collaborating to begin laying the groundwork for interoperable trust and assured data flow between Open Banking and Perseus

“Perseus helps small businesses cut costs and emissions, reduce reporting and bureaucratic burdens, and compete more effectively.”

Zarina Banu, Global Head of PR & Communications, Tide

- Technical and operational solution implementation

- Deploying a full sandbox (equivalent to production) for use by Carbon Accounting Providers (CAPs) and Energy Data Providers (EDPs) to develop against and demonstrate they are Perseus-ready (i.e. able to secure permission, retrieve SME energy data from a synthetic energy data provider, process it into emissions and generate a signed report)

- Implementing support for reporting in the standard XBRL format, foundations to make Perseus ‘plug and play’ for regulators, accountants and financial systems

Perseus will begin to roll out to SMEs in 2026, as scheduled. The go-to-market will be led by members, with communications supported by the Steering Group, and programme-specific activities operated by Icebreaker One (IB1) for and on behalf of members.

“Perseus makes it easier for everyone to do their carbon calculations properly, and comfortably moves us years ahead of the most stringent proposed updates to the GHG Protocol. This is exactly why Sage intends to roll out a Perseus enabled product to make reporting easier for hundreds of thousands of UK SMEs.”

George Sandilands, Vice President, Sage Earth

With Perseus now ready as a voluntary Smart Data Scheme, and operated under an open source ‘Scheme-as-a-service’ model, there is a significant opportunity to:

- Broaden applicability across SME financing not just ‘green loans’

- Open up innovation in products and market incentives (e.g.corporate tax relief)

- Increase the number of members (financial services, application vendors, data providers)

- Broaden the scope to include water and other categories as needed to support financial incentives

- Explore broadening the initiative to corporates and/or consumers

Stakeholder engagement will continue, along with membership renewal and expansion. This will fund the ongoing Scheme co-development, the delivery of use cases and case studies, communications, legal and policy and engagement. This includes the operation of trust services to deliver the Scheme in the market.

After two years of intensive development, with hundreds of stakeholders engaged, Perseus is now gearing for scale to help embed sustainability into our financial economy, as a pioneering cross-sector Smart Data scheme. To join, see ib1.org/join/perseus or email partners@ib1.org.