Icebreaker One is here to help deliver a demonstrably Net Zero Future.

Today Net Zero is framed around ‘carbon’ and greenhouse gas emissions. However, as we face multiple crises, including biodiversity and species collapse, ocean acidification and many other forms of systems-wide pollution, we consider that the definition of Net Zero could be helpfully expanded and reframed as Rise to Zero.

In our current political environment, Net Zero is reached when any greenhouse gas (GHG) emissions are reduced to zero in total (against 1990 levels). This anchors the phrase Net Zero to ‘climate‘, for now.

We believe it is a useful, context-neutral phrase that could be broadened to address the fact that the world is also looking to address its many, many environmental challenges and nature-based impacts.

Net Zero can go above and beyond as a phrase.

Net: balancing today, the past and the future

In considering Net Zero impact we should be ensuring that not only our current impacts are non-negative, but also address the historical impact of our actions. Our material sustainability is contingent on ensuring that the net sum of the harms and benefits we create don’t cause compound negatives: we need to ‘spend’ less than we make so that we don’t bankrupt the ecosystems which we rely upon to prosper.

There are also substantive moves to address double materiality — “The concept of double materiality takes this notion one step further: it is not just climate-related impacts on the company that can be material but also impacts of a company on the climate – or any other dimension of sustainability, for that matter (often subsumed under the environmental, social and governance, or ESG, label).”

This can only happen with a combination of both radically lower baseline impacts (e.g. emissions) linked to the things we do (including transport, energy, water, agriculture, our built environment) as well as removing any remaining impacts (e.g. emissions) with schemes that ‘offset’ an equivalent amount of impact — for example, greenhouse gases (GHGs) from the atmosphere, such as planting trees or using technology like carbon capture and storage, to ‘wind back the clock’ on the harms we have created.

It is important to recognise that reducing GHGs and then ‘offsetting’ the impact of any remaining emissions requires a joined-up approach. Offsetting cannot be a ‘get out of jail free’ card, but we also must acknowledge that no process has zero impact. Further, given the reality of how slowly we have been changing things, organisations must also consider retroactively addressing the impact of their historical emissions.

All such interventions will be disruptive to how we live today and require multidisciplinary action.

Global initiatives such as the Global Financial Alliance for Net Zero are trying to address this. In the UK it is enshrined in law that commits the country to Net Zero by 2050. Many countries have made national commitments to Net Zero targets, but there are very few implementation plans to get us there.

Icebreaker interpretations

At Icebreaker One we add the word ‘demonstrable‘ to indicate that any commitments must be quantifiable and provable throughout the process (from design to build, operations to decommissioning) from a financially relevant perspective.

For example, an investor, asset manager, or regulator could hold to account any project to deliver against the end targets throughout the lifecycle of the project. They could add warranties, covenants, and related contractual clauses to hold organisations to account.

Equally, we must accelerate the reality of our climate and nature-based science (and help translate the data) into policy and business strategy. To bring together the thinking and expertise to assess vulnerabilities (from assets to countries to global supply chains) and opportunities (re-engineering our energy systems) requires us to gather experts across sectors and work through the challenges.

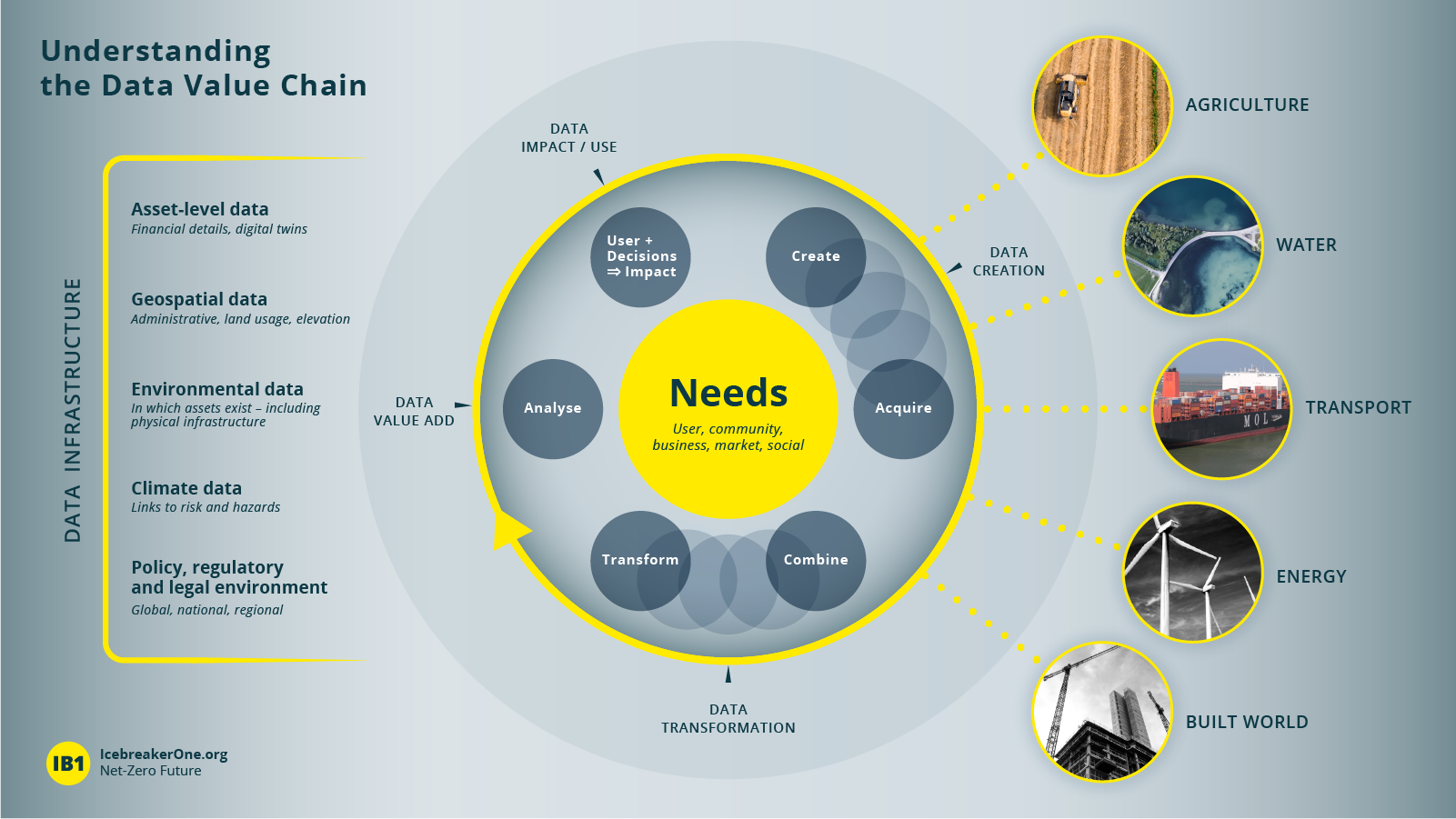

Our multidisciplinary teams are connecting climate science to policy, finance to engineering to help develop a coherent strategy for data-sharing: one that can help unlock real-world, relevant-time data flows from the point of investment, design and construction, continuously throughout its operation and finally measured at the point of decommissioning.

In our view, Net Zero has to mandate not just after-the-fact reporting, but continuous information flows throughout project lifecycles. Achieving this will require data-sharing at a scale we have never achieved, but we have the capabilities to do so today. We don’t need ‘new tech’, we need the will to join up our existing skills and expertise with the tools we already have and make them work for the benefit of everyone.

Doing so will enable:

- The creation of relevant financial instruments

- Holistic risk management

- Credible deployment of robust, long-term solutions for finance, infrastructure and assets