V2025-05-01

Organisations across the ecosystem can use a Trust Framework to share data at market-wide scale.

Here we try and bring together the acronym soup of organisations and initiatives worldwide that are working on net zero across climate, environment and finance. In this breakdown, we are describing:

- Sustainability reporting and disclosure organisations

- Sustainability organisations

- Climate action organisations

- Environmental data and technology organisations

- Policy and regulatory organisations

- Environmental measurement and assessment organisations

Update [2025-05-01]

The GHG Protocol is undergoing a comprehensive update of its corporate standards, including Scope 1, 2, and 3 emissions accounting. The revision process, initiated in 2022, is expected to culminate in the release of updated standards by 2027. These updates aim to align with best practices and enhance the effectiveness of GHG accounting for businesses pursuing science-based and net-zero targets.

The European Financial Reporting Advisory Group (EFRAG) has developed the Voluntary Sustainability Reporting Standard for SMEs (VSME) as part of the EU’s SME Relief Package. Published in December 2024, the VSME provides a simplified framework for non-listed SMEs to report on sustainability in a practical and proportionate manner.

The European Commission has proposed the “Simplification Omnibus” initiative to reduce the regulatory burden of the CSRD. This proposal includes exempting companies with fewer than 1,000 employees from CSRD requirements, potentially affecting around 80% of companies currently covered by the directive.

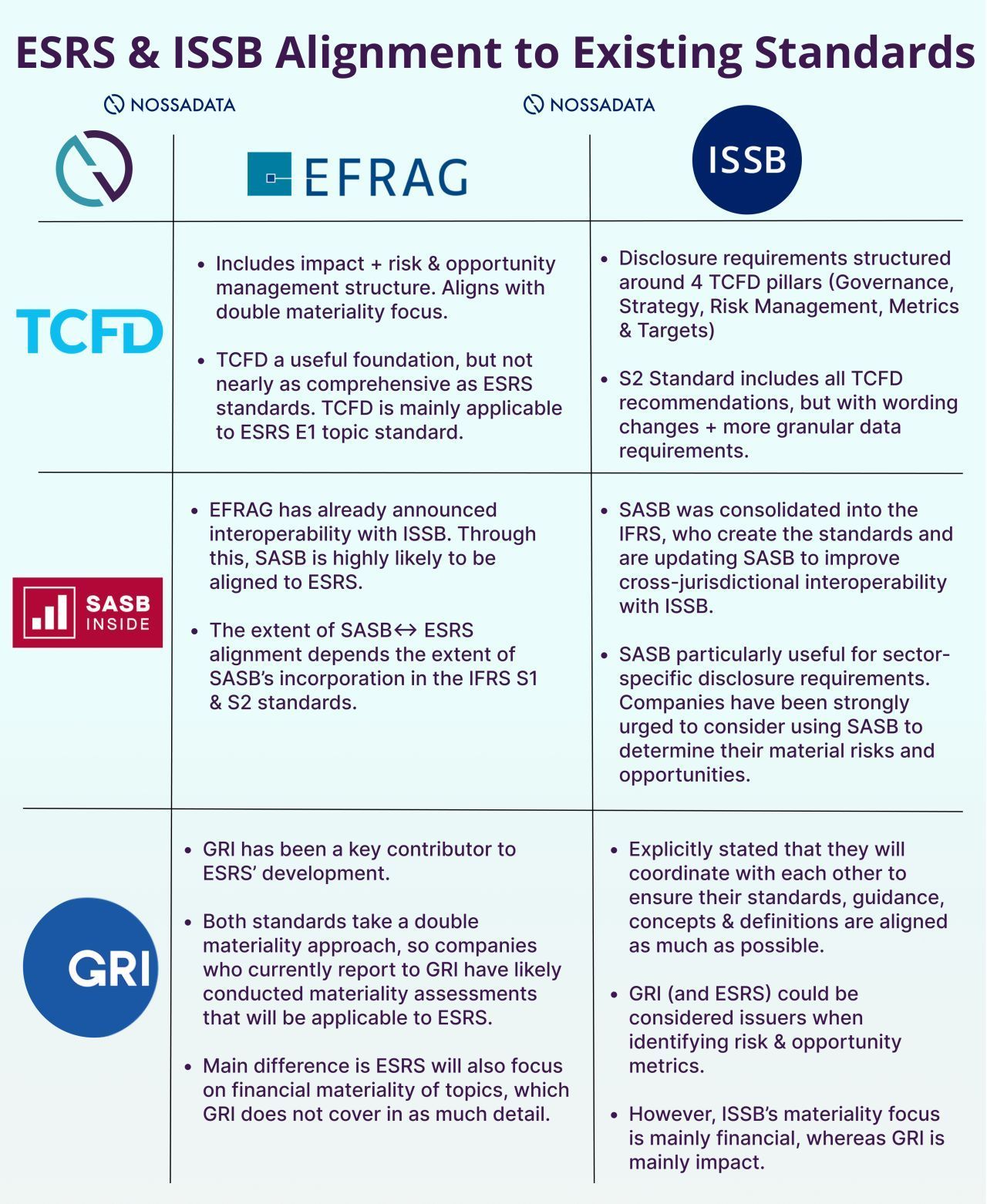

The International Sustainability Standards Board (ISSB) has issued its inaugural standards (IFRS S1 and IFRS S2) for sustainability-related disclosures, aiming to provide a global baseline for sustainability reporting. These standards are designed to streamline the numerous voluntary ESG frameworks and enhance comparability across organisations. It is in companies’ own interests to adopt standards.

Update [2024-06-26]

A granular mapping between the ESRS and the TNFD disclosure recommendations and metrics, and key findings, are detailed in this report:

https://tnfd.global/wp-content/uploads/2024/06/TNFD-ESRS-Correspondence-mapping-Final.pdf

A view of how this has evolved [2024-03-01]

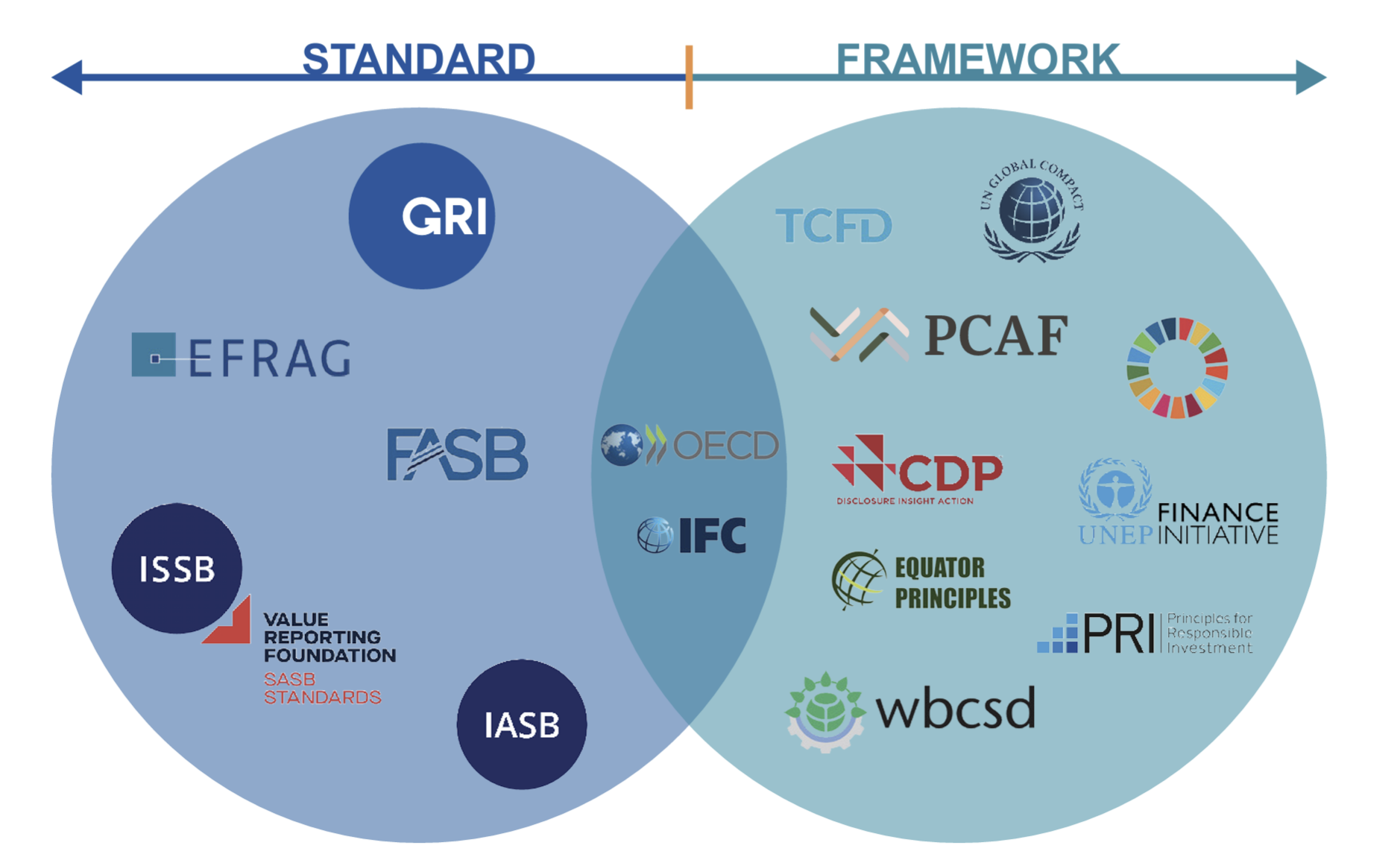

This paper from the Global Reporting Initiative (GRI) frames the sustainability landscape in two main directions: organisations that publish standards and the ones that issue frameworks or guiding principles. Of course, the world is not entirely black and white as some organizations tend to do both.

Another iteration below (via here), built upon https://www.wbcsd.org/Overview/CFO-Network/WBCSD-Implementation-Guidance-ISSB-Standards-and-ESRS

Ecosystem overview (Gdoc version, open to comment) v2023-11-01

This is not an exhaustive list, and the ‘example organisations’ are for illustration and not meant to represent the totality of actors in the space (there are thousands). We have related surveys that list a comprehensive set of organisations across the ecosystem at Climate, Environment, Finance, Infrastructure and Data (2019) and Climate Finance Initiatives (2021).

The list below is designed to help navigate the landscape and illustrate its complexity and reach.

For example, the Global Reporting Initiative (GRI) is a standard-setting organization that has developed a framework for sustainability reporting. The GRI Sustainability Reporting Standards provide guidance on how to report on a wide range of sustainability topics, but they do not set specific requirements for what must be reported. In contrast, the Sustainability Accounting Standards Board (SASB) has developed a set of industry-specific sustainability standards that establish specific reporting requirements for companies in each industry. Please also see our Glossary and our briefing note on reporting and disclosure.

For example, the CSDDD (Corporate Sustainability Due Diligence Directive) and the ISSB (International Sustainability Standards Board) are two distinct initiatives related to corporate sustainability. Here’s a brief explanation of the difference between them:

- Corporate Sustainability Due Diligence Directive (CSDDD): The CSDDD focuses on due diligence processes within corporate sustainability. It provides guidelines and frameworks for companies to assess and manage their environmental and social impacts, particularly in relation to their supply chains and business operations. The CSDDD aims to ensure that companies identify and address potential risks, mitigate negative impacts, and uphold responsible practices throughout their operations.

- International Sustainability Standards Board (ISSB): The ISSB is an initiative led by the International Financial Reporting Standards (IFRS) Foundation. Its primary focus is to develop globally recognized sustainability reporting standards for companies. These standards aim to enhance the consistency, comparability, and reliability of sustainability disclosures. The ISSB aims to establish a comprehensive reporting framework that enables businesses to transparently communicate their environmental, social, and governance (ESG) performance to stakeholders.

While the CSDDD concentrates on due diligence processes and management of environmental and social impacts within corporations, the ISSB focuses on developing global sustainability reporting standards to improve the quality and consistency of sustainability disclosures. Both initiatives play crucial roles in advancing corporate sustainability practices and promoting transparency in ESG reporting.

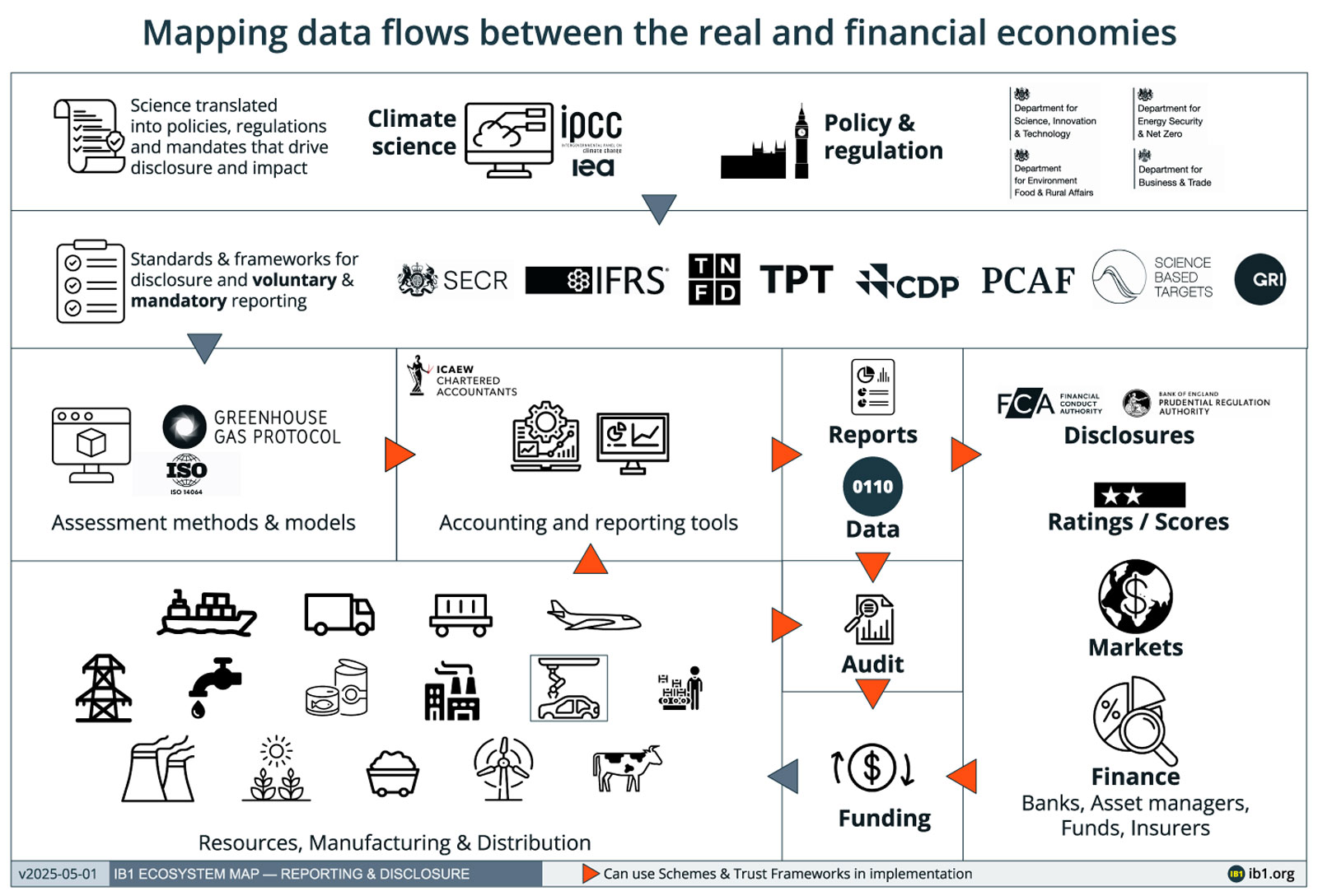

As an example, here is one view on the data flow including actors in the ecosystem, from the real economy to the financial economy. Ultimately, to give a sense of the ‘everythingness’ of the space, this also includes mapping right the way through to Environmental Product Declarations (EPDs).

Similarly, there are thousands of sustainable investment funds and products globally, including many funds that track climate change-focused indexes. Some of the largest index providers, such as MSCI and S&P, offer multiple climate change-focused indexes, and there are also smaller index providers that specialize in sustainability and climate change. [Global Sustainable Investment Review]

| Type | Sustainability reporting and disclosure organisations |

| Focus | Sustainability reporting, disclosure, and data management |

| Purpose | Develop frameworks, standards, and protocols to improve the quality and consistency of sustainability reporting and disclosure, and promote better data management practices |

| Examples of activities | Developing sustainability reporting and disclosure frameworks, promoting the adoption of sustainability reporting standards, providing guidance and support on sustainability reporting and data management, promoting the integration of sustainability data in financial reporting |

| Example organisations | Task Force on Climate-related Financial Disclosures (TCFD), System of Environmental-Economic Accounting (SEEA), Task Force on Nature-related Financial Disclosures (TNFD), EDM Council, Object Management Group (OMG), International Sustainability Standards Board (ISSB), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), International Integrated Reporting Council (IIRC), Carbon Disclosure Project (CDP), Climate Disclosure Standards Board (CDSB), European Federation of Financial Analysts Societies (EFFAS), World Business Council for Sustainable Development (WBCSD), the Corporate Sustainability Due Diligence Directive (CSDDD), Sustainability Standards Accounting Board(SSAB) |

| Type | Sustainability organisations |

| Focus | Environmental impact, climate change, sustainability reporting, ESG performance, and sustainability certification |

| Purpose | Develop frameworks, standards, and certifications to help organisations manage their environmental impact, reduce their carbon footprint, and promote sustainability |

| Examples of activities | Developing sustainability reporting frameworks and guidelines, promoting the adoption of sustainability reporting standards, providing technical guidance and support, developing standards for sustainable finance and investments, providing certification services for sustainable products and processes, promoting sustainability in supply chains |

| Example organisations | Carbon Trust, International Organization for Standardization (ISO), United Kingdom Accreditation Service (UKAS), American National Standards Institute (ANB/ANSI), Science-Based Targets initiative (SBTi), Gold Standard, Virtual Legal Entity Identifier (vLEI), EY, KPMG, PWC, Deloitte, Glasgow Financial Alliance for Net Zero (GFANZ), Future of Sustainable Data Alliance (FoSDA), Sustainable Finance Development Network (SFDN) |

| Type | Climate action organisations |

| Focus | Climate action, renewable energy, and sustainable development |

| Purpose | Mobilise support and action for climate change mitigation and adaptation, accelerate the transition to renewable energy, and promote sustainable development |

| Examples of activities | Developing and supporting climate action initiatives and campaigns, promoting renewable energy adoption and development, providing technical and financial support for sustainable development initiatives, promoting sustainable supply chain practices |

| Example organisations | Bloomberg Philanthropy, Climate Arc, DSD lab, Carbon Call/Climate Works, RE100 |

| Type | Environmental data and technology organisations |

| Focus | Environmental data, analytics, and technology solutions |

| Purpose | Develop and promote data and technology solutions to help organisations manage their environmental impact, improve risk management, and promote sustainability |

| Examples of activities | Examples of activities: Developing environmental data standards and protocols, providing environmental data analytics and modelling tools, developing environmental risk management solutions, promoting open data and collaboration in the environmental data space |

| Example organisations | London Stock Exchange Group (LSEG), Bloomberg, Risk Management Solutions (RMS), Applied Insurance Research (AIR) Non-commercial enablers (‘precompetitive’ layer) Icebreaker One, OS Climate, Oasis Loss Modelling Framework |

| Type | Policy and regulatory organisations |

| Focus | Environmental policy, financial regulation, and sustainability standards |

| Purpose | Develop and promote policies, regulations, and standards to promote environmental sustainability and support sustainable finance and investment |

| Examples of activities | Developing environmental policies and regulations, promoting sustainability standards and frameworks, providing guidance and support to financial institutions and regulators, promoting sustainable finance and investment practices |

| Example organisations | Government, Regulators |

| Type | Environmental measurement and assessment organisations |

| Focus | Developing standards, providing data and analytics, conducting research, and promoting sustainability to support climate action and environmental management.Purpose: Advancing understanding and measurement of environmental impacts and helping organisations and policymakers make informed decisions to reduce those impacts. |

| Purpose | The purpose of these organisations is to develop and promote internationally recognised standards for measuring and managing greenhouse gas emissions, provide data, analytics, and insights to support climate-related decision-making by businesses, investors, and policymakers, conduct research on climate change and its impacts, and develop and implement strategies to transition to low-carbon energy systems. |

| Examples of activities | Developing and promoting internationally recognised standards for measuring and managing greenhouse gas emissions (GHG Protocol, UK Defra, US EPA), providing data, analytics, and insights to support climate-related decision-making (OS Climate, Climate Action Data 2.0, MSCI), conducting research on climate change and its impacts (Grantham Institute, CISL), promoting energy efficiency and renewable energy (CGFI, Utilities), and collecting and analysing data from satellites and other remote sensing technologies to monitor and understand changes in the Earth’s climate, ecosystems, and natural resources (Earth observation data) |

| Example organisations | GHG Protocol, UK Defra, US EPA, Climate Action Data 2.0, CISL, CGFI, Grantham Institute |

ISO standards relevant to ESG

ISO 14001:2015 – Environmental Management Systems (EMS) helps develop a systematic approach to managing environmental impacts.

ISO 14064:2018 focuses on Greenhouse Gas (GHG) Quantification and Reporting, aiding in quantifying and reporting GHG emissions and removals.

ISO 26000 provides Guidance on Social Responsibility, crucial for Environmental, Social, and Governance (ESG) efforts.

ISO 37301 assists in managing ESG-related risks with Compliance Management Systems.

ISO 27001:2013 addresses Information Security Management Systems (ISMS), protecting against security threats.

ISO 14007 and 14008 offer guidance on Environmental Costs and Benefits.

ISO 20400:2017 promotes Sustainable Procurement.

ISO 37001:2016 focuses on Anti-Bribery Management Systems.

ISO 50001:2011 targets Energy Management Systems (EnMS) for better energy efficiency.

ISO 14040 and 14044 cover Life Cycle Assessments (LCA).

ISO/WD 53001, aims to support the UN Sustainable Development Goals (SDGs) through a comprehensive management system covering all aspects of ESG.