This FAQ addresses questions related to our Standard for Environmental Risk and Insurance (SERI).

Announcements

FAQ

- What is the business need, challenge or market opportunity?

- What is your approach and focus?

- What does the market you are targeting look like?

- How are you going to grow, track benefits and impacts?

- What wider impacts might this initiative have?

- How do you define the ‘data infrastructure for climate-ready investment’?

1. What is the business need, challenge or market opportunity?

We have identified that financial markets are not using data at scale to understand climate risks and exposure.

An 18-month consultation across industries (300+ individual experts across 200+ organisations) our interviews have indicated that the increased frequency of extreme weather events is depleting insurers’ resources, pushing insurance premiums to unaffordable levels and adding new risks to business models. In the UK, parts of this risk are being offset by the government via schemes such as FloodRe. As the effects of climate change deepen, reliance on government support is expected to increase.

The inhibitor to using data is not technology, but culture. Organisations are stuck in legacy models that mandate they hold information ‘closed’ and negotiate potential uses of their data on a case-by-case basis. We are holding back our innovation: data is not discoverable, it is not clearly licenced for use, it is not in formats that people or machines can easily manipulate. We need better ways to share it, robustly, legally and securely to create value, rather than leaving it in increasingly stagnant data lakes.

The business need is that climate change and extreme weather events and related hazards are impacting profits and need to be better quantified and addressed to ensure we are ‘climate-ready’. This spans mitigation, adaptation and resilience.

For example, the total premium volume of the UK Life and Non-Life insurance market in 2017 was just under £200B (Swiss Re, 2017), making the UK insurance market the largest in Europe and the fourth largest in the world (ABI, 2019). The Life market makes up 2/3rds of the total.

Simultaneously, climate change and extreme weather events are impacting profits. In 2018, global losses from what insurers term as ‘natural catastrophe losses’ hit an all-time high at US$ 160 billion (£125 billion), with half of these losses insured (Munich Re, 2019). Munich Re (2019) notes that the “loss burden for insurers [is] substantially higher than the long-term average”. With 2018 being the fourth-highest year of losses on record (Aon, 2019), it is becoming clear that climate change poses a threat to the UK insurance industry and the UK economy at large. The Governor of the Bank of England, Mark Carney, first drew attention to climate risk in 2015, and revisited the issue in 2019, stating “We call on policymakers and the financial sector […] to collaborate to bridge the data gaps to enhance the assessment of climate-related risks.” The same sentiment was reflected in the Bank of England and Prudential Regulation Authority’s Supervisory Statement (SS319) which called on financial institutions to incorporate risk into their balance sheets.

Enabling access to environmental and financial data will deliver a £multi-trillion opportunity and will address the climate crisis.

The creation of open standards for shared data will enable a better understanding of risks and climate exposure. This will enable investors, asset managers and insurers to improve current product offerings, underwrite new risks, and develop new business models that innovate on the climate crisis. Icebreaker One, will unlock private good: enabling businesses to make money, save money and reduce risk. Equally, it will unlock public good: enabling countries to protect citizens, the environment and their economies.

Icebreaker One has already mapped over 200 initiatives working across climate, finance, environment and data. We have identified that no other initiative is working on the area that Icebreaker One is addressing—the full-spectrum (processes, principles and practices) standards that enable data sharing across businesses.

The wider economic, social and environmental benefits are wide-ranging. The development of the Open Banking Standard in the UK—and in development around the world—has created a substantial inflection point for intervention. Open Banking was created by convening teams to develop common principles and practice for sector-wide data sharing. They included existing and challenger banks, trade bodies, Treasury and regulators. In the UK, this led to the creation of an independent non-profit (funded by the banks) to develop and take the standard to market, and to accredit the organisations using it. There are now 300+ organisations registered to operate in this space.

The standard was (and is) developed openly. As a result, it has helped to catalyse initiatives around the world. Similar initiatives now exist across Australia, Bahrain, Europe, Hong Kong, India, Japan, Mexico, Malaysia, New Zealand, Rwanda, Singapore and the USA.

This work is being extended to ‘Open Finance’. The Financial Conduct Authority currently has two advisory groups: one examines extending Open Banking to all areas of the financial sector, including insurance; the other focuses on climate, financial risk and innovation. Our founder sits on both FCA advisory groups, chairing on cohesion and interoperability.

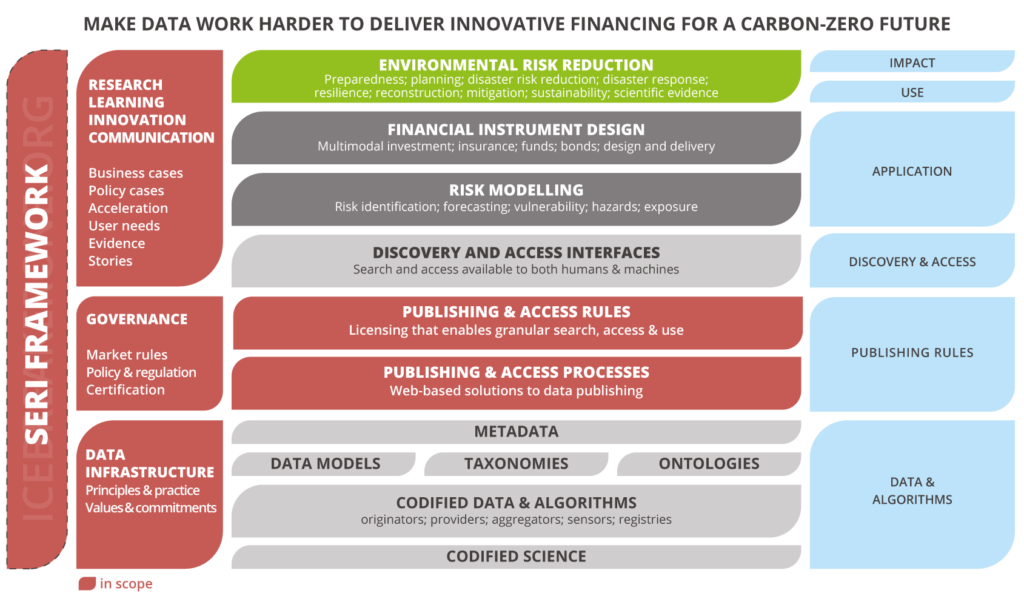

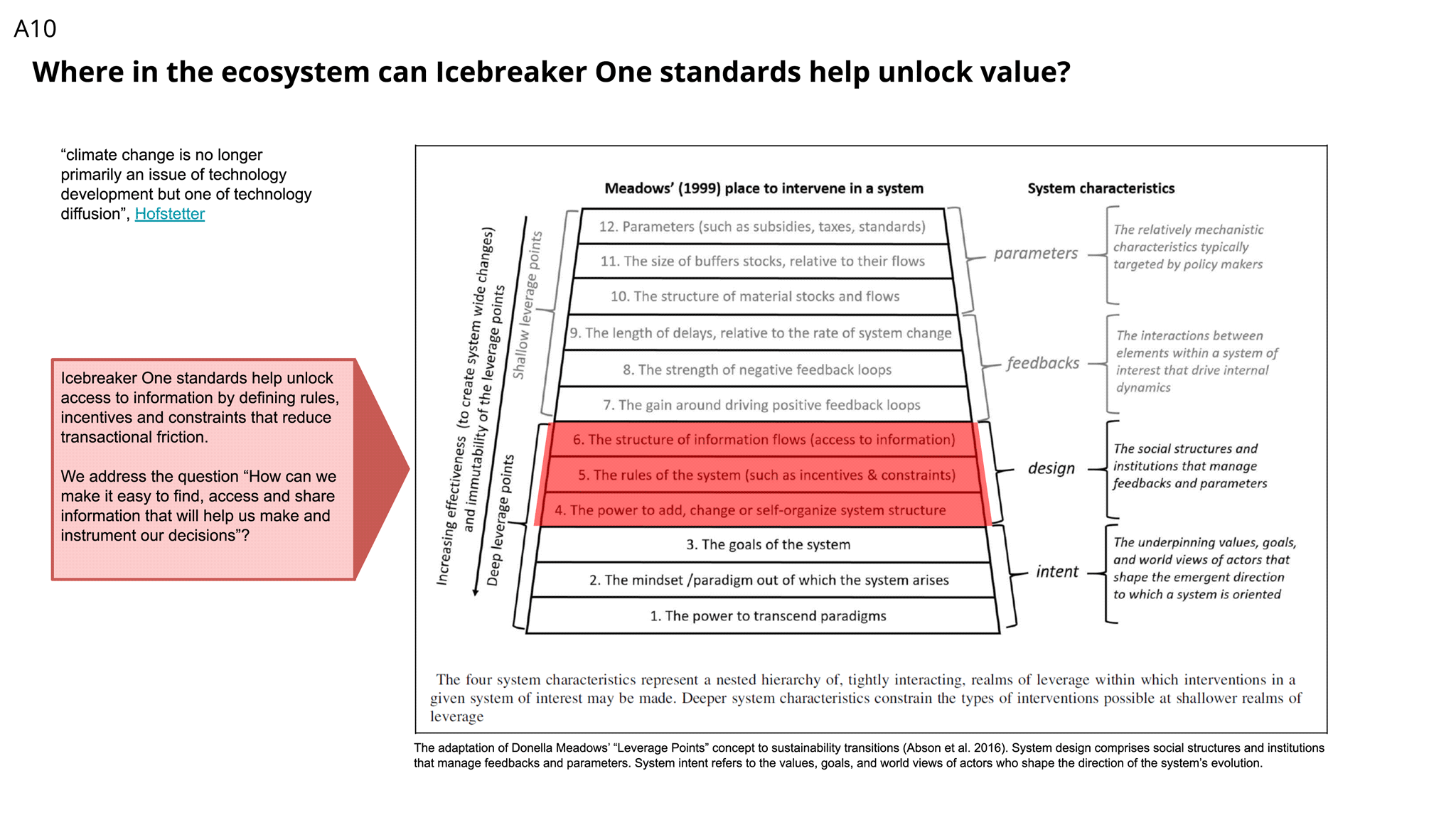

2. What approach will you take and where will the focus of the innovation be?

We will develop open standards that enable access and use of environmental and financial data. Our focus is on enabling the foundational ‘plumbing’ aspect of data access to unlock industry innovation. Licensing, and specifically preemptive licensing, is an essential aspect of enabling access to shared data. This is fundamental to accelerate the adoption of artificial intelligence in insurance, investment, asset management and other sectors.

Without a clear understanding of how data can be used, for what purposes, and under which conditions it can be licensed, the current high-friction environment will continue.

Creating clear access rules, as well as addressing rights, liability transfer, dispute resolution, security, legal frameworks, usability and related issues is essential. We will convene the relevant stakeholders across sectors to develop open standards. The scope for derivate product innovation is substantial. Our industry and academic partners already represent a significant group in the financial & data ecosystems, and we are engaging with broader markets throughout development.

Innovation will be focused on culture change, rather than the development of new technologies. Learning from Open Banking and Open Finance, we will convene the relevant stakeholders to develop the shared principles and practices to enable the use of existing technologies. Many organisations are not currently utilising data at-scale due to the high costs and friction in transactions. On implementation, it will enable organisations to share data robustly, legally and securely, driving the use and adoption of algorithmic (including machine and artificial intelligence) tools across sectors. We will do this by identifying the specific use-cases and user needs and identifying the product and policy innovations that will emerge from the creation of an open standard.

We have identified the need for an independent third party to convene the relevant stakeholders, breaking through silos in order to overcome this collective action challenge, and will assume this role.

As an independent, non-partisan non-profit, Icebreaker One is best suited to lead the development, including players from across the value-chain, including competing insurance brokers, engineering firms, data providers, legal expertise, academic researchers specialising in artificial intelligence, and start-ups building innovative products. This diverse mix of actors, led by an independent third-party will enable us to operate freely of specific vested interest.

We will enable the financial sector and related value-chain businesses to become more competitive as investors, asset managers, insurers, model vendors and brokers will be able to improve current product lines and develop new business lines and new business models. By developing specific use cases and enabling access to new and emergent types of data, open standards developed will stimulate (standards-based) marketplaces that will allow businesses to share and access data for both public and private good, safely and securely, under specific licensing conditions. By reducing this transactional friction, current products can be improved and made ‘climate-ready’. We have begun developing potential use-cases at https://ib1.org/use-cases/

We will demonstrate a multidisciplinary approach and address the broader, non-technical aspects.

The initiative will take a multi-pronged approach across six nodes of activity, to address the cultural barriers (including rights, ethics and bias), as well as enable the technical specifications needed. The working groups will focus on: governance, culture, learning, making, standards and data infrastructure.

The nature of the outputs we expect include standards which we will have tested with market actors. The precise nature will be determined during development: this is a user-needs driven initiative. We expect the outputs to include a Phase 1 open standard published by end 2021Q1, with in-depth use-cases and updates published at regular intervals throughout: we will publish outputs on a continuous basis at key events (e.g. COP26, UN, etc).

These outputs, developed iteratively and in collaboration with the end-users, will enable us to address user-needs, and catalyse data access and thereby innovation. The results will accelerate the update of new technologies such as machine learning and artificial intelligence.

3. What does the market you are targeting look like?

In our description of markets, we delineate between (a) the potential marketplace that can be unlocked through the use of open standards, and (b) the market for direct partners and funders.

Open Banking is a useful reference and benchmark. The implementation of open banking is managed via an initiative called ‘OBIE’. OBIE is co-funded by the banks to support a ~£7M/year cost-base. Open Banking is unlocking a £18B/year market (http://bit.ly/2NGXn5h). We are building on the ‘sunk costs’ and prior art of the OBIE (which will also now downsize) to develop as a £3M/year cost-base initiative to help unlock a potential £300B/year market.

To illustrate, addressing just geospatial data sharing in the UK is estimated to hold a potential £6-11B in untapped value (http://bit.ly/2BY9ncY).

Total Addressable Market (TAM)

The total premium value of the UK insurance market in 2017 was just under £200 billion (Swiss Re, 2018), making the UK insurance market the largest in Europe and the fourth largest in the world (ABI, 2019). The global insurance market in 2017 was US$4.89 trillion (£3.77 trillion), with all areas showing growth save for the UK; a trend largely attributed to Brexit (Swiss Re, 2018).

Simultaneously, climate change and extreme weather events are impacting insurers’ profits. In 2018, global losses from what insurers term as natural catastrophe losses hit an all-time high at US$160 billion (£125 billion), with half of these losses insured (Munich Re, 2019). Munich Re (2019) notes that the “loss burden for insurers [is] substantially higher than the long-term average”. With 2018 the fourth-highest year of losses on record (Aon, 2019), it is becoming clear that change poses a threat to the UK insurance industry and the UK economy at large.

The UK spent £18.9 billion on infrastructure in 2016 (ONS, 2018). The current global infrastructure spend is $2.9 trillion (£2.4 trillion). In order to keep up with demand, the global infrastructure investment would need to be $3.7 trillion (£2.85) per annum between 2016 and 2040 (Oxford Economics, 2018).

Serviceable Addressable Market (SAM)

The serviceable market is, at scale, the global industry. Icebreaker one aims to influence investment through developing common standards, principles and practice in collaboration with its partners, who represent over $3 trillion (under advisory or management). The products and services impacted should have influence over at least 10% of this market, $300B.

Serviceable Obtainable Market (SOM)

We are targeting the creation of common principles and practice: the potential obtainable market for impact is, in principle, is equal to the market size. However, not all standards are adopted globally and it is reasonably expected that multiple standards will exist. Note that our members already represent over 10% market share (in insurance).

Barriers to innovation

A core barrier to innovation is that climate risk is not being properly priced into financial products. Currently, business models use historical data to set course (e.g. insurance premiums are set on a yearly basis depending on the previous years’ losses). Incorporating climate risks will require shifting into a forward-looking market. The necessary value and supply chains must include new types of data: this data is currently not discoverable, not addressable and is not easily licensed for use. We aim to address these specific market and business needs.

4. How are you going to grow, track benefits and impacts?

Following an 18 month consultation with industry, policy and individual practitioners, we are now formally establishing our market position. Throughout this process, we have spoken to 300+ experts, each of whom has emphasised a need to increase the use of shared data, and the need to lower friction in data transactions with the development of an open standard.

Target customers include insurance, reinsurance, risk-modellers, asset managers, engineers, investors and financial managers. The value to them is to radically increase insights into risk (specifically climate risk). For example, earlier in 2019 the Bank of England highlighted that the central banks across Europe have a $20T liability sitting on their balance sheets. Through their joint Supervisory Statement with the Prudential Regulation Authority, they have also emphasised the need for insurers and those in financial services to better account for climate risk.

A measure of value will be to enable the adaptation (or invention) of financial products & services that adequately embody the systemic risks of climate change and its cascade risks (ranging from weather hazards to civil unrest through mass migration). The initiative will generate private and public good, enabling businesses to make money, save money and reduce risk, whilst simultaneously closing the protection gap. Currently, vulnerable citizens remain uninsured, and as climate risk increases, the number of homes considered uninsurable is expected to rise. The opportunity is for industry and government to work together, enabling countries and regions to protect citizens, their environment and economies.

Organisations will use our products and services to enable them to find, access and use the information they need to make risk-informed decisions. Modelled on the blueprint of the Open Banking Implementation Entity, Icebreaker One will be able to maintain a directory of actors implementing standards, offer research, certification, training and implementation support services.

Our route to market has been to convene market leaders as well as engaging across silos to address both supply- and demand-side participants.

This is a demand-driven initiative, so engaging with customers to directly understand user needs is central to our agile approach in market engagement.

The organisation has a blended funding model, with corporate membership and sponsorship, public and philanthropic grant funding. The model is based upon the successful prior implementation of the Open Data Institute—of which Icebreaker One’s founder was the founding CEO.

Icebreaker One is a non-profit organisation. However, it also aims to unlock leveraged funding from commercial investors (via a federated accelerator) to create new for-profit subsidiaries and spin-offs, which will generate a long term returns to the non-profit.

In the short-term, the innovation will enable risk to be better quantified, improving market resilience and enabling product innovation. Longer-term, the innovation will enable the market to measurably and sustainably address systemic risks that exist on the balance sheets of every major company.

The outputs of the initiative will, wherever relevant, be openly licensed.

As a core benefit, it addresses the collective-action challenge that participants are unable to achieve individually. Service lines will be developed to provide paid training, sector research, horizon scanning, certification and related tools to deliver additional direct or subscription revenue streams. Recognising that standards require iterative development, Icebreaker One will maintain the standard and its evolution, The standard will be openly licensed through Creative Commons to encourage rapid innovation through imitation, as with Open Banking. The result of openly licensing the UK’s Open Banking Standard has been that, based on the UK’s example, over 20 countries are now implementing or scoping its implementation.

The approach is repeatable and has been tested successfully in prior organisations. Design patterns will be tested and built upon using an agile approach to develop and deliver federated proposition for specific sectors. These include, but are not limited to, infrastructure investment (e.g. bonds) and asset management. Territory-based expansion already includes AsiaPacific, Europe and North America.

5. What wider impacts might this initiative have?

Icebreaker One could yield substantial economic benefits across the economy and, in particular, the economic stability of global supply chains. Addressing and reducing climate risk is a central issue that will affect the performance of all large businesses and many small businesses. Open Banking has been estimated to be unlocking an £18 billion/year market. Addressing just the geospatial area of data sharing in the UK (one out of the five areas of data which we will focus on) is estimated to hold a potential of £6-11 billion in untapped value. Applying the model developed through Open Banking to data-sharing for finance across different data types will unlock significant value.

The outputs of this initiative are linked directly to the Green Growth Strategy, the national 2050 carbon net-zero target and the Industrial Strategy of countires. We aim to provide the linkages between these.

The mission is to create positive environmental impact at scale, to enable the countries to hit their carbon net-zero targets in a manner that is demonstrable, accountable and meaningful. It will enable the data flow necessary for businesses and governments to understand the climate risk of their investments, and create decisions that are demonstrably carbon net-zero.

Enabling systemic information sharing of environmental risks across the financial system will likely result in both policy and regulatory interventions. We are already engaged with regulators (e.g. UK Financial Conduct Authority (FCA)) on potential frameworks for intervention. Linking between policy, industry and climate is central to the development of the initiative.

Given the localisation of large-scale customers, the majority of the direct economic influence will be centred in London and major financial centres. However, the commercial impact will be national and regional and will enable an increase in resilience nation-wide.

Addressing climate risk will lead to investment decisions that directly impact people’s quality of life and safeguard jobs. We will help facilitate employment transition (through research, training and knowledge-sharing) within a data-driven economy, the impact of which is already affecting the financial sector. For example, we will help insurers innovate to close the protection gap of vulnerable households currently without insurance, the number of whom is projected to increase with climate uncertainty as more areas and homes are deemed too expensive to insure.

Our projected impacts include:

0-3 years: Startup: engagement with leader-organisations; clear use-cases; product innovation; prototyping; market testing; demonstrator commercialisation; description of the technology readiness level (TRL) approach and pathway to scale.

3-5 years: Scaleup: engagement with whole-sector; repeated application of the TRL approach to facilitate organisational transformation; repeatable commercialisation.

5-10 years: Iteration: whole-market adoption; continuous development of best-practice; direct funding of product innovation; demonstrable returns for individual actors; demonstrable quantification of GDP impact; measures of progress and impact to the climate net-zero goals.

More broadly, we will lay the foundations for commercial data-sharing that enables the transition from a silo-based, bilaterally contracted system today, to a federated, preemptively licensed, machine-ready data marketplace that can operate at industrial-scale.

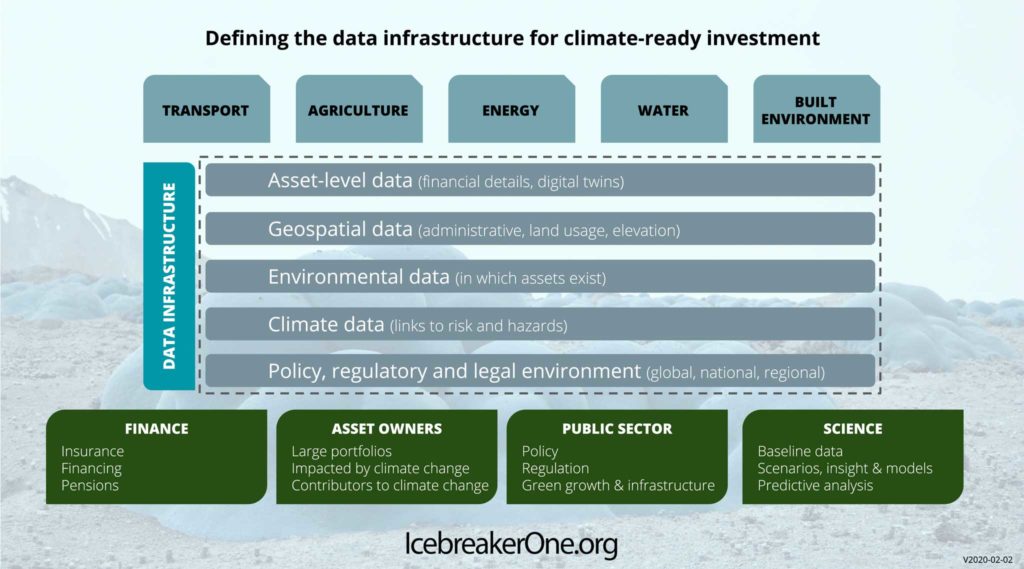

How do you define the ‘data infrastructure for climate-ready investment’?

Addressing the climate crisis requires us to combine innovation across finance, policy, our physical and data infrastructures.

Physical vs data infrastructure

It is easy to see our physical infrastructure—including energy, water, transport, built environment, agriculture. Our financial systems are also clear—including investors, insurers, asset owners and managers and banks. Policy is shaped by known structures at city, national and international levels. Our scientific institutions have huge resources and knowledge to share.

We are evolving the principles and practice around the data infrastructure required to bring these areas together in a coherent manner: how can we create product and service innovation that properly quantifies and codifies risk, and makes it actionable by markets?

The data infrastructure for climate-ready investment

We are exploring the data are needed to support innovation that spans finance, policy, engineering and science in practical and actionable ways: How can we design for humans and machines in the process, to make data findable, usable and re-usable?

- Asset-level data (financial details, digital twins)

- Geospatial data (administrative, land usage, elevation)

- Environmental data (in which assets exist — the physical infrastructure)

- Climate data (its links to risk and hazards)

- Policy, regulatory and legal environment (global, national, regional, local)

For whom?

- Financial markets: Insurance; Financing; Pensions

- Asset owners: Large portfolios; those impacted by climate change; contributors to climate change

- Public sector: Policy; Regulation; Green growth & infrastructure

- Science: Baseline data; Scenarios, insight & models; Predictive analysis

We highlight three priorities for data-driven innovation:

1. Design for search to enable data discovery

2. Pre-enable access to data to unlock action

3. Understand user’s needs so they can create impact

1. Design for search to enable data discovery

We currently don’t know what exists and can’t easily find things. We need organisations to publish open data descriptions of the data that they hold so that it can be found. This will help people identify what questions might be answerable and where the data gaps are.

2. Pre-enable access to data to unlock action

Much like Creative Commons explicitly gives permission for re-using content in advance, we need to work out how to pre-emptively license data for different use-cases. At the moment even if we can find the data we need it is hard to license for a specific use. This is also likely to require regulatory intervention.

If we are enabling greater data discovery, we need to follow through and enable greater access, without negotiating every use on a case-by-case basis. Some data will be highly confidential or carry security or ethical concerns. Working together we can work this through to reduce the ‘transactional friction’ in getting access. This will need to involve legal, business, policy and technology experts.

3. Understand user’s needs so they can create impact

Finding and accessing data is useless unless the data we get is usable. We need to build on the huge wealth of knowledge, examples, principles and practice that has helped shape the web to truly unlock the web of data for everyone.

We are focussed on helping with these challenges. The areas in red below are in scope and enabling to others.