v2024-08-13 [PDF download]

Aim and purpose

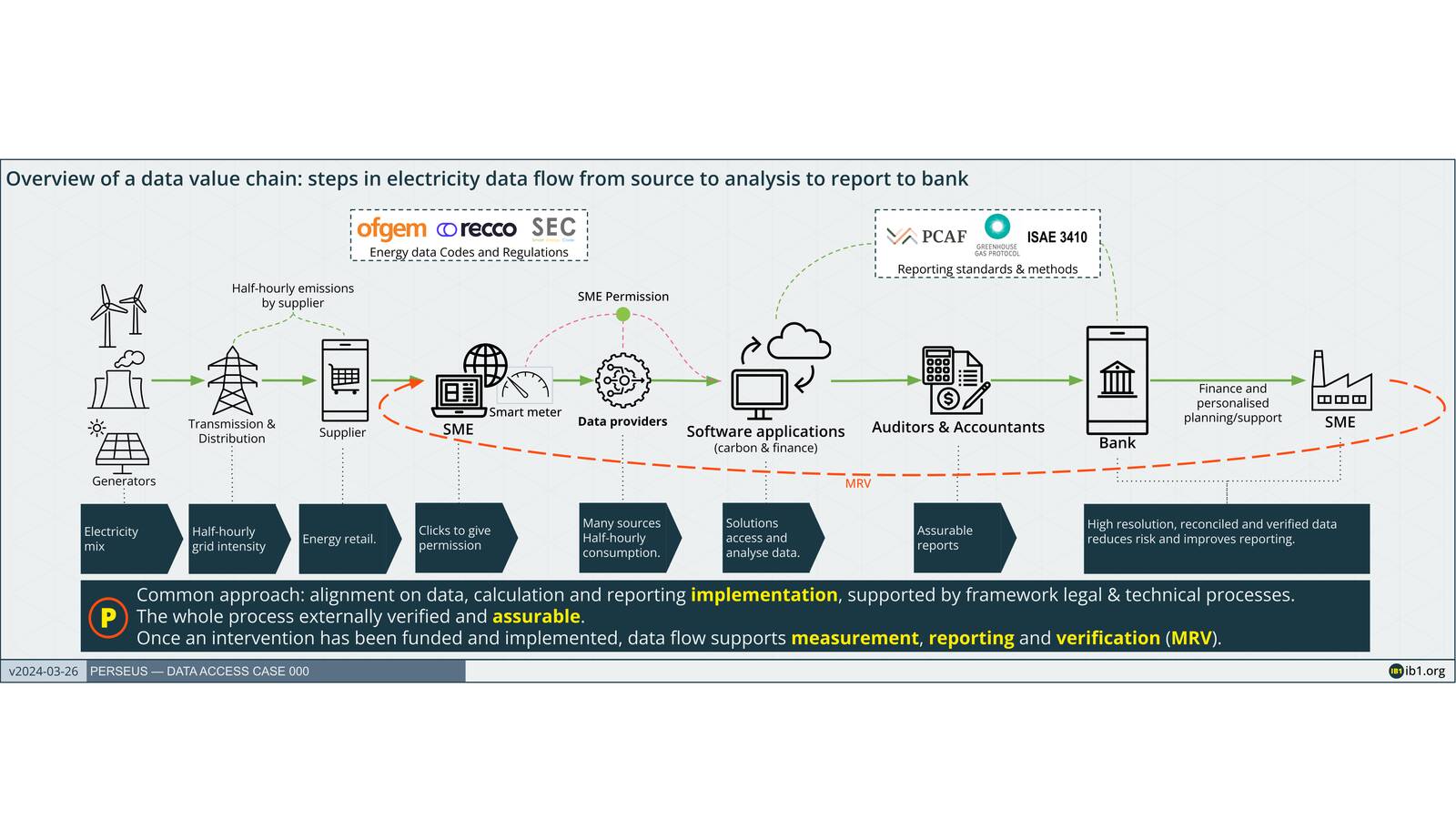

The purpose of Perseus is to unlock access to finance from banks and lenders to UK SMEs to reduce their emissions faster and quantify the impact of such finance. Its objective is to reduce emissions faster. It will help this by automating assurable sustainability reporting for every SME business in the UK.

Perseus achieves this by:

- Making it easy to automate the sharing of accurate, assurable data which underpin critical components of measurement, assessment, reporting and verification.

- Investment impact MRV (measuring, reporting, and verification) of reductions in emissions based on the financed interventions, as distinct from compliance-based reporting.

- Compliance reporting by the Banks and Lenders at the highest score within regulated frameworks (PCAF).

- Supported by Analytics that:

- Assess risk, helping Carbon Accounting Providers (CAPs) support Banks and Lenders to finance SME customers, and/or

- Provide personalised recommendations: CAPs, Banks and Lenders can all help their SME customers on the net zero journey (e.g. “install a heat pump, or switch supplier”). These may or may not need financing.

- Based on Calculations of accurate, consistently applied, assurable greenhouse gas (GHG) emissions.

Why these are necessary to achieve Perseus’ aims:

- Assurable GHG emissions calculations are necessary to:

- Quantify emissions in an accurate, verifiable and defensible manner

- Establish a trusted baseline of business emissions against which future progress can be reliably measured across the market

- Understand and measure the sources of business emissions

- Understand and profile business emissions (e.g. seasonal variability) on a continuous and reliable basis

- Analytics are necessary to:

- Examine the types of interventions which could help the business reduce emissions, and why these are effective

- Prioritise interventions which are likely to have the biggest and/or fastest impact on emissions reduction

- Understand the requirements for finance (capex, opex, both) to facilitate the above interventions

- Explore the risks and benefits associated with different types of intervention (e.g. return on investment, payback periods, co-benefits, carbon reduction)

- Provide transparency and assurance to SMEs, Banks, and Lenders about potential interventions and associated finance options

- Reduce the risks of green lending to Banks, Lenders, and SMEs

- Enable Banks and Lenders to evolve and diversify green finance products and customer portfolios based on assurable data

- MRV is necessary to:

- Accurately assess the measurable impacts of interventions taken by the SME to reduce emissions (financed or unfinanced)

- Enable reporting against different standards, processes and audit

- Enable transparency for all parties regarding the effectiveness of interventions and their verification

- Inform future choices in the SME’s net zero transition and financial planning

- Reduce the risks of green lending to Banks, Lenders, and SMEs by providing material evidence of what works

- Reporting by Banks and Lenders is necessary to:

- Meet regulatory compliance

- Provide transparency to customers and the general public

- Drive behaviour change aligned with policy and commitments

- Improve trust and confidence in the net zero transition

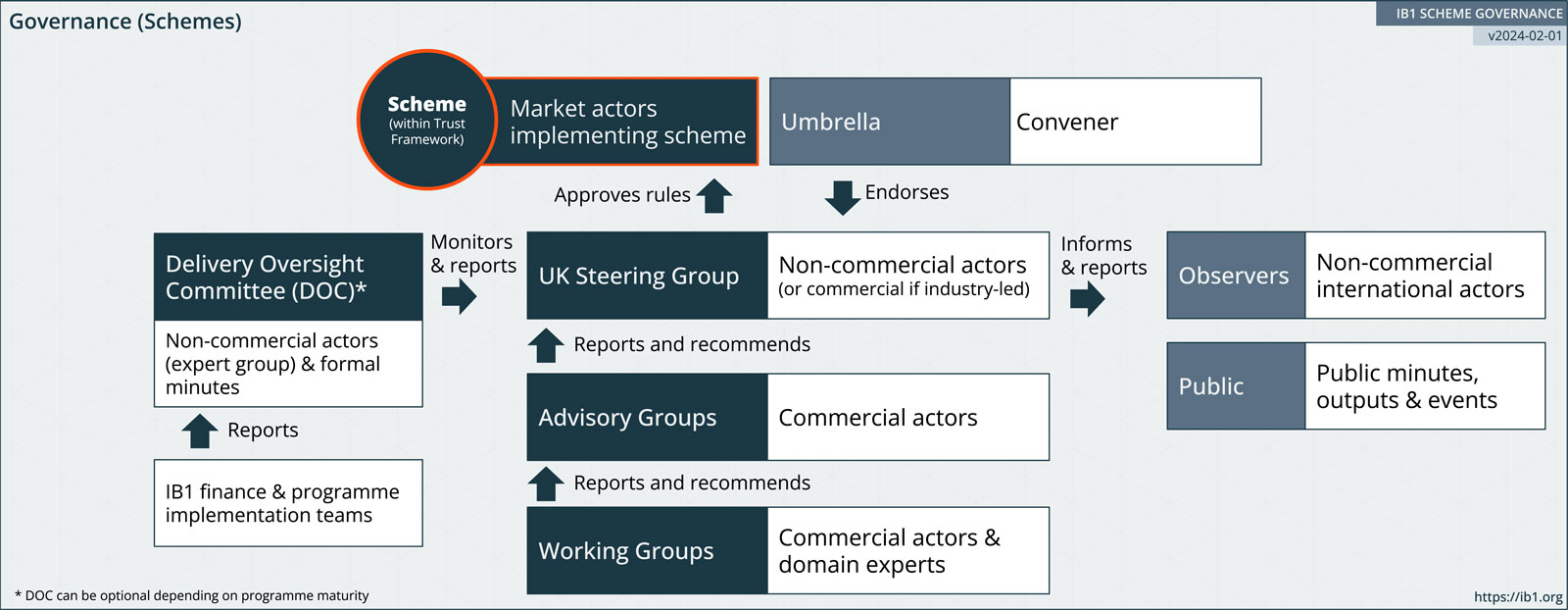

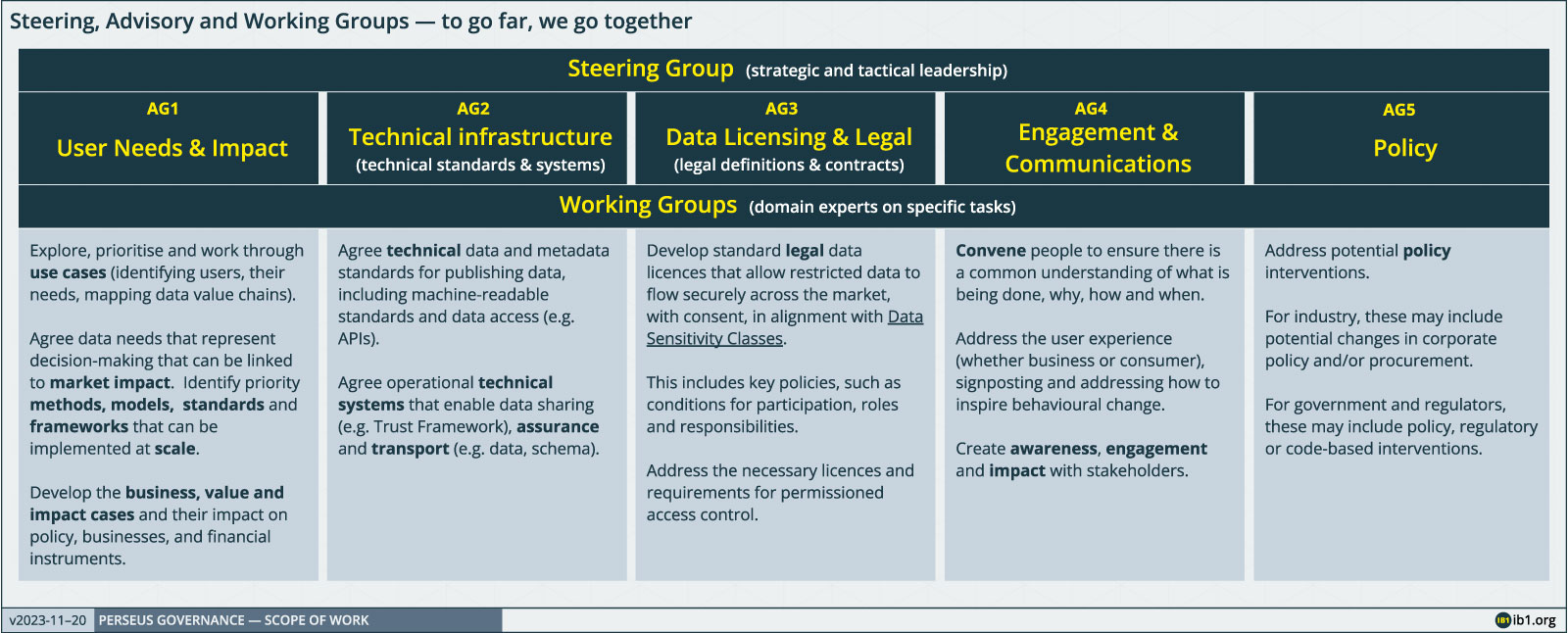

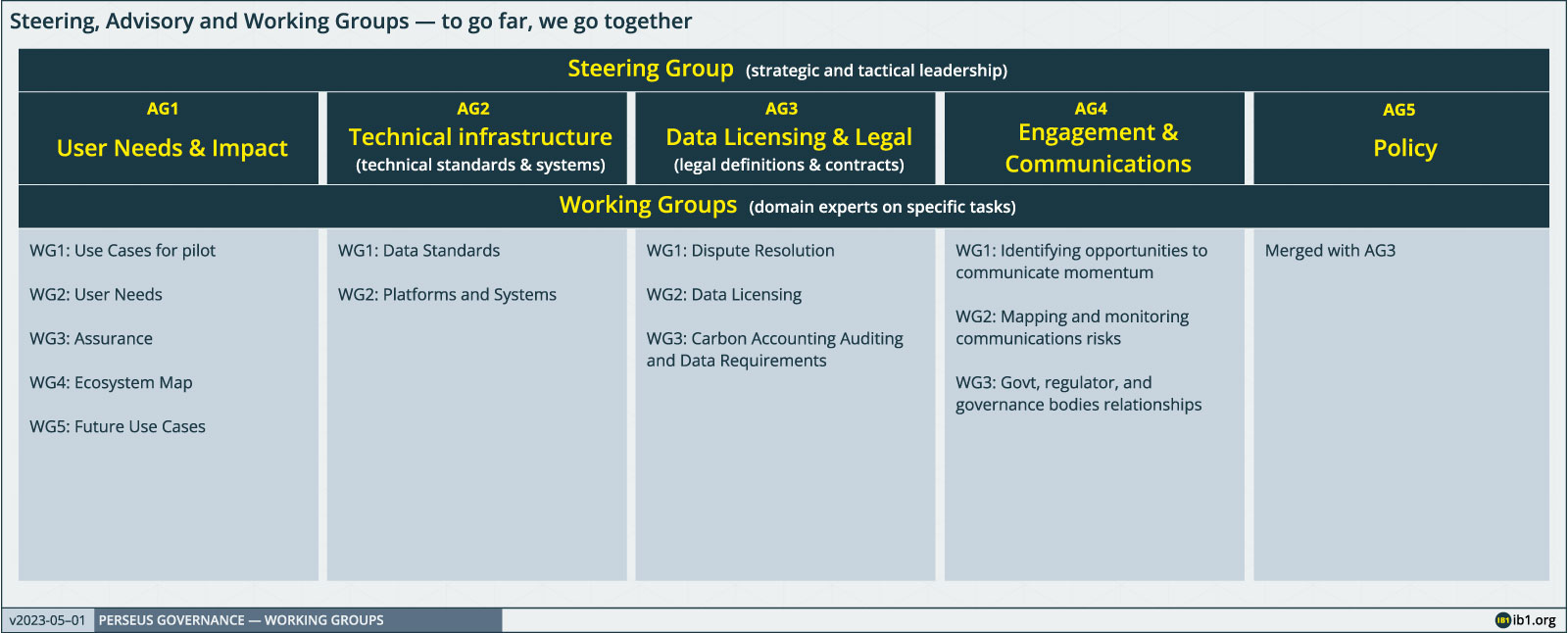

- A multilateral approach is necessary to

- Ensure clear and transparent data usage across the value chain, with robust protections for SMEs and market actors.

- Ensure joined-up compliance with existing legal frameworks (e.g. GDPR), emerging national legislation (e.g. Smart Data), and sector-specific regulation and governance (e.g. Smart Energy Code).

- Harmonise frameworks for the Perseus members including, but not limited to, calculation, benchmarking, liability transfer, and dispute resolution.

- Simplify and coordinate the user experience for SMEs including (but not limited to): simple and transparent permission to enable data access and onward sharing, legal protection and compliance, a common and transparent approach to GHG calculation and benchmarking, data chain assurance to support trust, and simplified access to financial lending products and services that can accelerate the net zero transition.

- Engage with a wide range of stakeholders who are designing, developing, and participating in, open markets facilitating the net zero future.

Supporting images

Back to Perseus home page

Please contact us at perseus@ib1.org if you would like to discuss anything.