This blog is the second part of a mini-series that we have written as part of the SERI programme. We’re always looking for people to join us on SERI and to help improve our thinking. To share your thoughts or to get involved in this programme please get in touch.

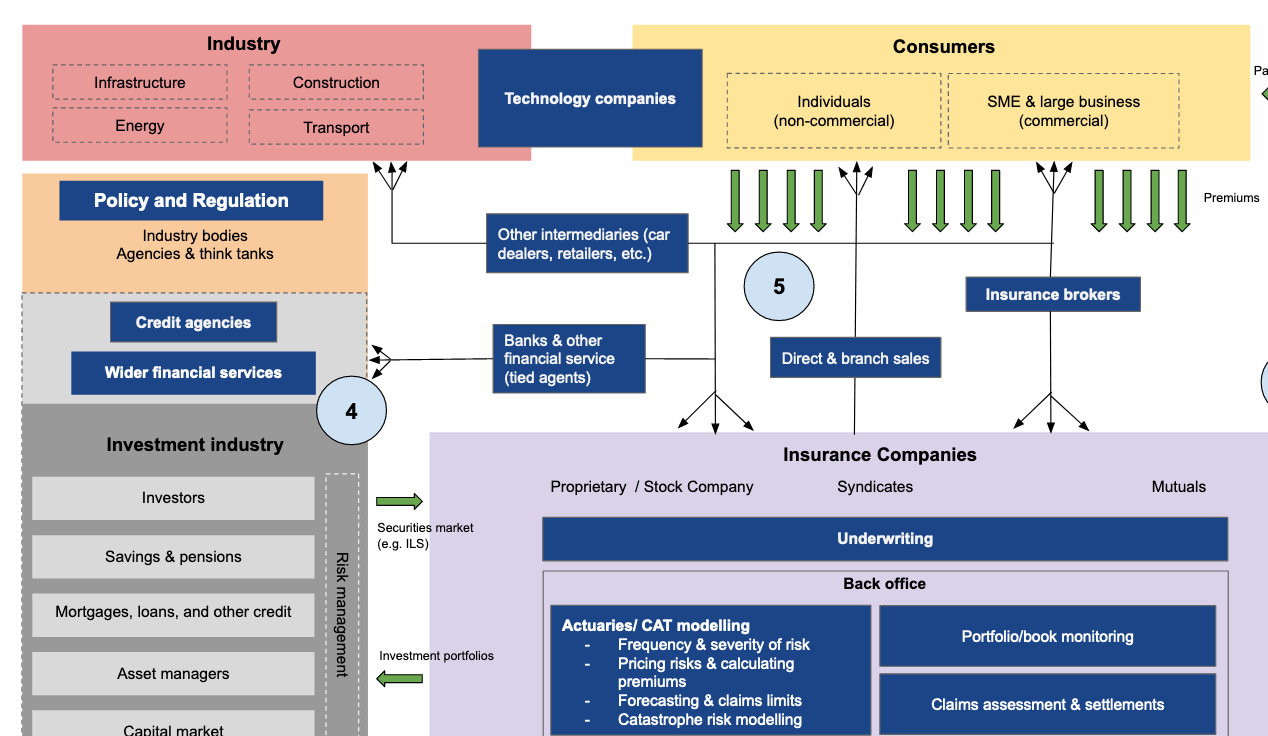

In the first part of this mini-series, we looked at the sections numbered 1, 2 and 3 in the insurance landscape image to explore what types of insurance exist, the different structures and what insurance business models are based on. Here we look at sections 4 and 5 to explore how insurance relates to the rest of finance and how insurance is distributed to buyers of insurance.

The sections of the insurance landscape are discussed in this blog. You can access the full graphic here. To learn about sections 1, 2 & 3, read the first blog of this series.

4. Insurance and the wider financial services industry

As we have seen in the previous section, the insurance industry is closely linked to the wider financial industry through the investment of premiums. Furthermore, a stock insurance company can receive money from external investors (i.e. not only from premiums paid by policyholders) from the securities market through financial instruments known as insurance-linked securities (ILS). ILS are bought by investors who are willing to take on the potential risk of a catastrophic event for the reward of the guaranteed premiums. If the catastrophic event does not occur, then the investors make money. Creating, selling and trading these financial instruments require a high level of sophistication and industry know-how, and not surprisingly access to high-quality data.

What about regulation?

Insurance is a highly regulated industry within the wider financial marketplace with strict requirements to ensure insurance companies have the ability to fulfil their contractual obligations of servicing claims. Credit agencies play a significant role in the insurance market by assessing and monitoring an insurance companies’ solvency, or ability to make payouts. Hence, credit agencies are important data users in the insurance landscape and rely on data to accurately assess insurance companies’ credibility and fiduciary function, thus providing dependable ratings not just for the buyers of insurance but also for the insurance industry’s impact on financial markets.

5. Insurance distribution

Insurance brokers, intermediaries or insurance sales arms act as the interface between the customer or user of insurance and the insurers. Hence, the distribution channels hold key information about customer behaviour and industry demand. Technology companies are increasingly moving into these segments of the insurance marketplace with the growing digitalisation of insurance distribution and robo-insurance.

Technology uptake such as with smart devices, Internet of Things (IoT), wearables and even remote sensing data has led to innovations in insurance products and processes, but not without challenges relating to data use, ownership and privacy. Most disruption has been at the customer and operations segments of the insurance value chain; such as with the use of open and shared data from the financial industry to determine a policyholder’s ability to pay premiums, thus disrupting centuries-old insurance assessment processes. Promising structures that aim to streamline other segments of the market, such as claims processing and monitoring, are also emerging.

What next?

Insurance is a heavily synergetic marketplace due to the sharing or transferring of risk through invested capital, not just within the industry itself but across the wider financial marketplace and other industries such as energy, infrastructure and transport.

Establishing standards for data sharing to open up channels internally and across industry can facilitate interoperability to speed up attaining mandated net-zero targets. Here, we have explored the stakeholders and possible data segments in insurance for the SERI project, but the whole picture is not yet complete. Next, we aim to delve deeper into specific sections of the insurance data systems and data-flow landscape to understand more about data used in insurance to help us develop climate-ready insurance products.

Got feedback? Get in touch!

SERI is holding a series of stakeholder engagement activities over the coming months. If you have any questions, comments or would like to know more, please get in touch.

One thought on “Mapping the insurance landscape part 2”

Comments are closed.