In the transition to net zero, the insurance industry can play a critical role in helping stakeholders manage and transfer risks. Data sits at the heart of insurance operations which could assist the transition. However, data sharing is one of the biggest barriers to success as the insurance industry is infamous for its limited data sharing often due to perceived (and sometimes real) competition issues. However, the industry is starting to look into solutions for the transition to a carbon net-zero future. The Standard for Environment, Risk and Insurance (SERI) project is looking to tackle this problem in a more systematic manner through creating a secured shared data governance framework that brings all valuable insurance related data together with the support from industrial partners and advisory groups in the insurance value chain.

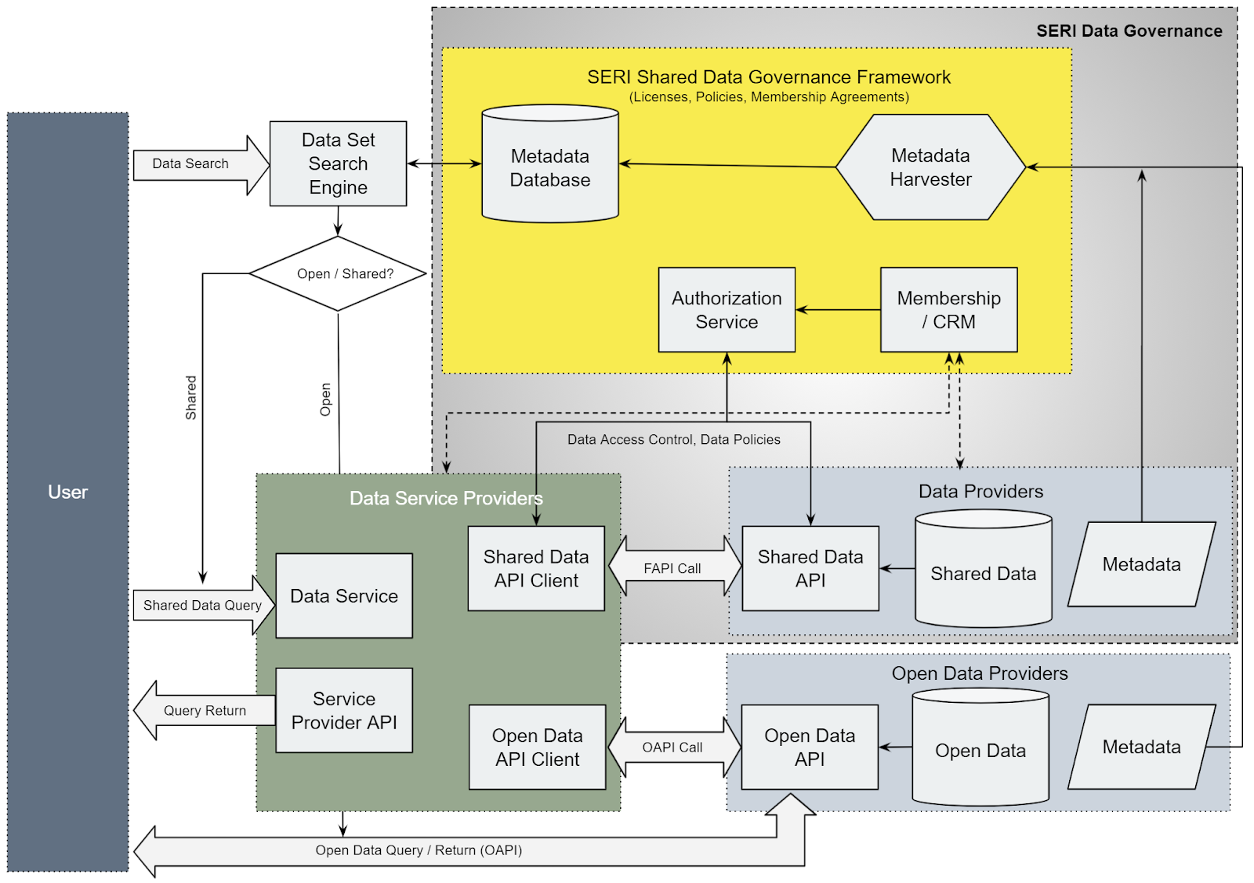

Figure 1 The SERI Shared Data Infrastructure, where API stands for the “application programming interface”, FAPI stands for the “Financial grade API”, and OAPI is the “Open API”.

The SERI shared data governance framework is a Shared Data Infrastructure (SDI), built on Open Banking and Open Energy foundations and many open data sharing standards (e.g. preemptive licenses). The key components of the SERI SDI are Data Authorisation Service, Membership/customer relation management (CRM), Metadata Harvester and Database, and Datasets Search Engine. Data and data service providers are brought to the SERI SDI through membership agreements. Data providers publish their data descriptions and register their licensing options per type of use through preemptive licensing or open data licensing for data users to access at different levels. Data remains in data providers’ databases under their management, performing data cleansing, verification, updates and correction locally. Data flows from member data providers to member data service providers through Application Programming Interfaces (APIs), where shared data flows through a secured financial grade API (FAPI), designed for industries (e.g. financial industry) that require higher API security; open data flows through a public/open API (OAPI) that may incur security issues at circumstances. Data users can search data from the Datasets Search Engine and access them directly from data providers or data service providers by complying to their respective licensing requirements. Figure 1 illustrates the SERI SDI ecosystem and how data flows within the system.

Within this infrastructure, collaboration with a wide range of stakeholders makes data discovery, aggregation, management, and sharing through federalised data services much easier and more efficient. Data governance within the infrastructure ensures a secure platform for many current Closed Data to be shared in confidence through preemptive licenses. This can potentially unlock a whole range of new data (e.g. financial, business and environmental data, especially mitigation data for climate change) for businesses to innovate and potentially incentivise net-zero behaviours.

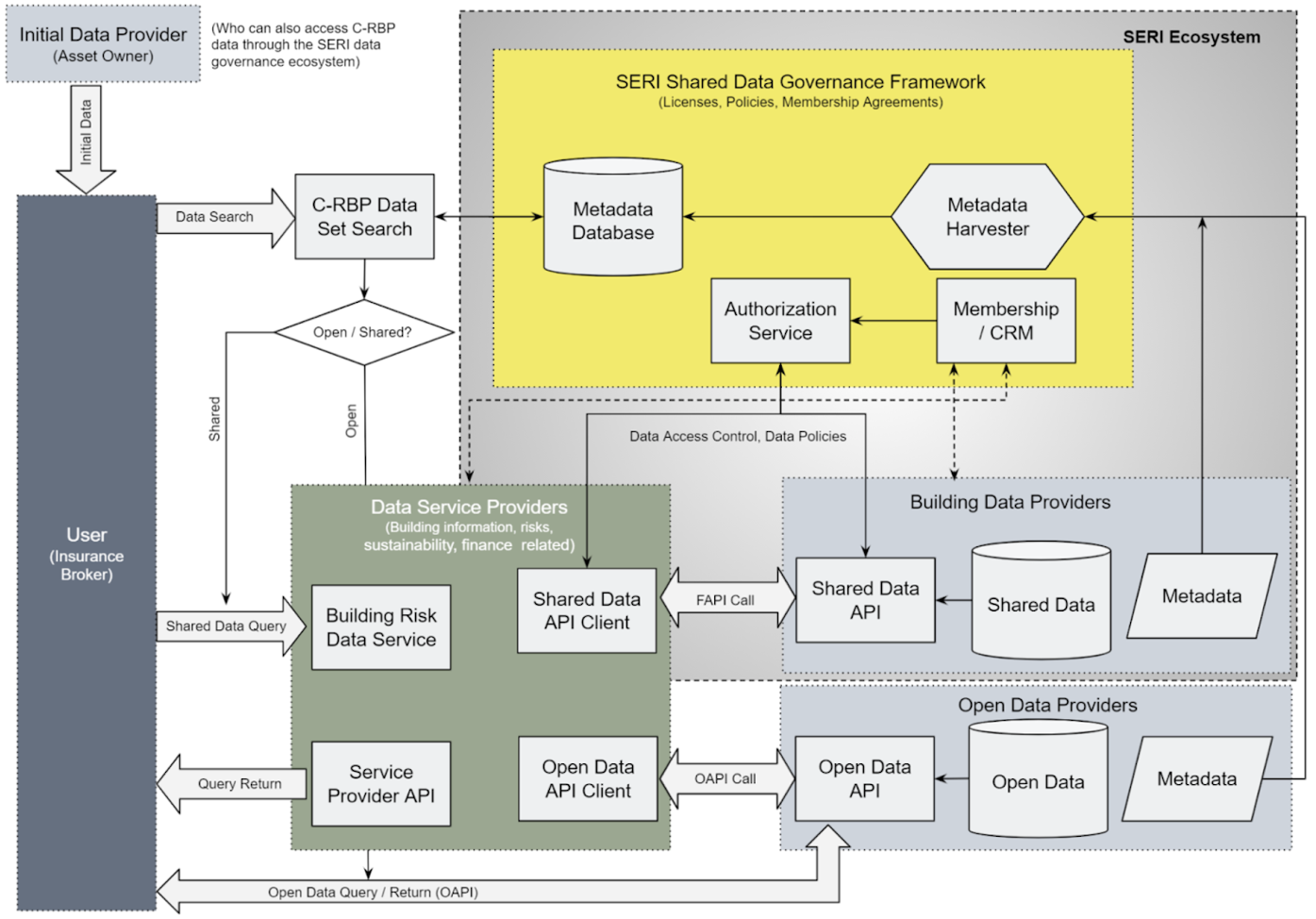

The Phase 1 SERI SDI is currently conceptual, at its embryo development stage and needs well defined use cases to demonstrate its value and how it works. The SERI team has developed a Climate-Ready Building Passport (C-RBP) concept as a service from the framework, associated with an industrial verified insurance market use case from a broker’s perspective. This use case demonstrates what commercial values the framework can create and how it assists the insurance industry incentives net-zero behaviours. In this use case, a broker was helping an asset manager to insure their complex assets (with many old and not retrofitted). Although they received a list of data from the asset manager, there would still be a number of extra data needed due to various reasons such as missing data, errors, data not usable etc. They have to shop around for data to fill the gaps from various third party data providers in order to be in a good position to negotiate the best insurance outcome for their customers. Data is fragmented, scattered and hard to find, and data related to sustainability in general is not identifiable or available. It is very challenging to find all the data the broker needs. A new service is needed to resolve this problem.

Figure 2 SERI Shared Data Infrastructure – A Broker’s view from the Climate-Ready Building Passport Data Service (Where API stands for the “application programming interface”, FAPI stands for the “Financial grade API”, and OAPI is the “Open API”).

Figure 2 maps the major components of the SERI SDI for the use case and demonstrates how the broker can access different types of data (either Open or Shared) through the C-RBP service. Through the service, the broker can easily discover various building information and building risk data (inc. both resilience and mitigation risks, either open or shared) from the C-RBP search engine on the framework from his computer. Once data is identified, the system will show him his eligibility to access and how to access the data, through open or preemptive licenses. Potentially he may only need to go through one of the data service providers of the framework to access all required data. He no longer has to ask around for data and go through many bilateral contracts/agreements. The datasets from C-RBP are all digital and machine readable, and are produced under structured data standards, making it easy to use and convert. This saves time, effort and money, and enables new datasets (e.g. operational data, emission data) to be discovered to give the broker insights to innovate.

Call for Support

We are currently seeking more input from stakeholders in the insurance value chain to develop the C-RBP and the SERI SDI further. If your work is in a related field and you’d like to be involved in this initiative we would love to hear from you, please get in touch by emailing us at seri@ib1.org.

Photo credit: Image by Pete Linforth from Pixabay