We asked Bill Roberts, former Head of Open Banking at the CMA, for his thoughts and reflections on Perseus. He highlights the following opinions, which are summarised in five points.

- Impact on SMEs

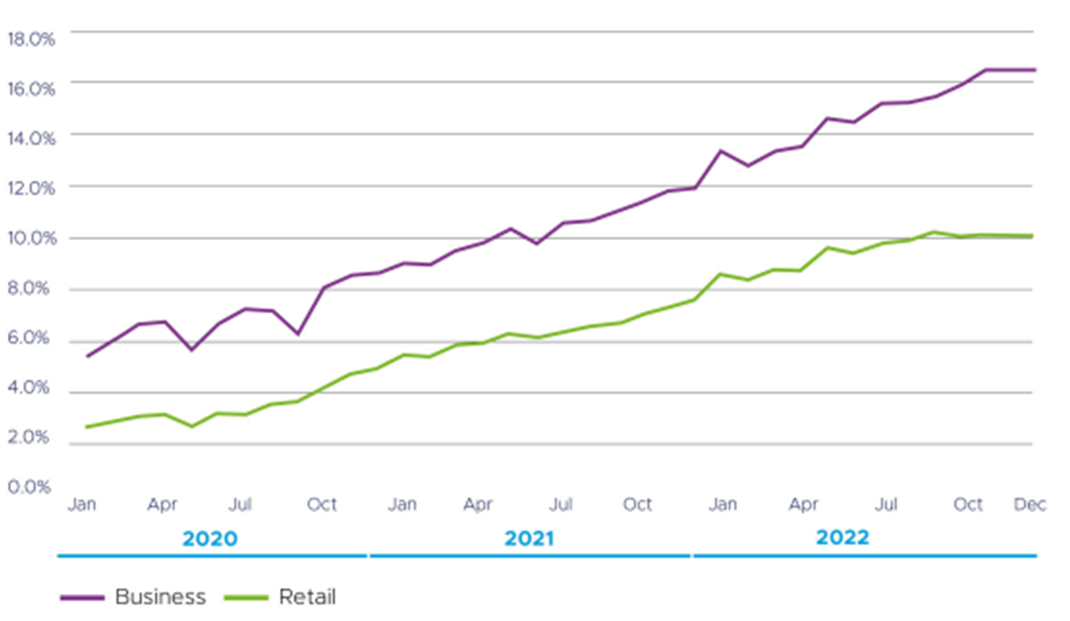

Open banking has had a significant impact in the UK, enabling consumers to access innovative financial services from accredited providers who have been granted secure access to their bank transaction data by consumers. The impact on small businesses has been greater still, with consistently higher penetration of the SME sector throughout the implementation period.

- SMEs as early adopters – innovation or efficiency?

SMEs tend to be early adopters of technology: they bought the first fax machines and mobile phones and adopted personal computing ahead of consumers generally. However, they have adopted open banking not because they are natural innovators but because it saves them time and money, for example replacing manual reconciliation of accounts payable with cash in the bank and tax filing.

Project Perseus has the potential to do the same: it can save them time (in filing data based on energy consumption) and money (by providing lenders and brokers assured data on their GHG generation). - Building on what’s there today

Most of the building blocks for Perseus are already available or soon will be through the smart data council. As with any data-sharing ecosystem, Perseus will need a Trust Framework (user authentication/authorisation and provider accreditation) as well as common security and messaging standards. The model if not the actual structures/standards for these are already in place as a result of work done for open banking, open energy and the pensions dashboards but there is little or no incentive for any individual company to adopt these standards even though the benefits of collective action are plainly visible. This was essentially the problem that ensured that open banking would not be adopted on a voluntary basis by individual firms. - Incentives

The lesson is clear: to take this project forward it will be necessary to either:- provide individual entities with an incentive to participate in the ecosystem (including adhering to its standards and protocols) or

- make adherence mandatory.

- Compliance

As noted above, SMEs already have (financial) incentives but banks and intermediaries do not. That said, the “Long Term Regulatory Framework” referred to repeatedly in the JROC recommendations for the future of open banking does suggest that regulators may, at least in the next two years or so, have the powers to mandate compliance with the standards incorporated in a wide range of data sharing schemes.

Firms would be ill-advised to oppose adopting standards voluntarily that they will shortly be required to adopt. Given this, it would be to the advantage of relevant regulators to participate in the current round of informal discussions being facilitated by Icebreaker One as they could help ensure that industry-led plans mesh with the regulations that will ultimately come into force.