Please contact us at perseus@ib1.org if you would like to discuss anything.

V2024-05-10

All project overview documents, terms of reference, pricing, timelines, screenshot mockups, and lists of members are available from the Perseus programme page. If you have any other questions, please get in touch with us perseus@ib1.org.

Contents

- Scope

- Q: Are we building a database or an app?

- Q: Is this just about electricity data?

- Q: How does Perseus relate to initiatives such as the Net Zero Data Public Utility (NZDPU), EU’s ESAP, XBRL, GHG accounting frameworks?

- Q: What’s the plan for this year, next year and beyond?

- Q: Is your end goal more accurate carbon reporting?

- Q: Why 30-minute electricity consumption data?

- Q: Will users pull smart meter data every 30 minutes?

- Time and money

- Q: Do we have to pay?

- Q. What will the money be used for?

- Q. Can we pay in-kind only?

- Q: What’s the time commitment?

- Business case

- Longer versions of the business cases

- Q: Why should we fund this rather than just wait for everyone else to fund it and come in later?

- Q: What’s the business case for a bank?

- Q: What’s the business case for an energy company?

- Q: What’s the business case for an SME?

- Q: What is the business case for 3rd parties?

(accountants, accountancy software firms, carbon accountants, auditors, consultants and advisors) - Q: What’s the value case for the UK?

- Who is involved?

- Q: Who is on the Steering Group?

- Q: Who is on the Advisory Groups and why?

- Q: Who are Bankers for Net Zero?

- Q: Who are Icebreaker One?

- What about the data — trust, security and confidentiality?

- Q: Is this a technology solution? We have our own application…

- Q: Does Icebreaker One, B4NZ or ‘perseus’ store or ‘see’ the data?

- Q: How will this be enforced? Will it be regulated?

- Q: Won’t banks use this data to penalise SMEs?

- Q: What are the lessons learned from Open Banking and the national data strategy?

- Q: What about artificial intelligence (AI), machine learning (ML) and related technologies?

1. Scope

Perseus will enable data sharing from the real economy (e.g. energy) to the financial economy (e.g. banks) at market-scale with the consent of the SME. The most successful and proven mechanism that enables this functional need is a Trust Framework for data sharing. This framework is supported in the UK’s Data Bill and Smart Data Council as part of the UK’s national data strategy.

Q: Are we building a database or an app?

A: No. This is about creating the processes that enable data sharing that are compliant, legal, and can scale for many users and applications. It is additive to existing calculators and database initiatives and will help them work more efficiently and robustly. This programme is about pre-competitive access to data that is required to reduce friction in the market.

Q: Is this just about electricity data?

A: No. This is about creating the ‘rails’ for data flow at scale:

- Making collective decisions around standards, processes and materiality, technical implementations, legal frameworks, communications and policy

- Enabling assurable data to flow automatically for environmental reporting

We are starting with electricity data as a way to achieve these goals and build the ‘rails’ for data to flow. In parallel, the project will consider which other data flows will represent the greatest materiality and should be the next for which to automate sharing. Future development will include other data, as needed by the market (e.g. other fuel types, water, transport, agriculture, etc).

Q: How does this programme relate to initiatives such as the Net Zero Data Public Utility (NZDPU), EU’s ESAP, XBRL, GHG accounting frameworks, etc?

A: Everything Perseus is doing provides additionality to those initiatives and does not duplicate them in any way. Icebreaker One’s work is already listed in the NZDPU’s White Paper as a potential part of the solution, it is working with XBRL and others in unlocking the data flow. Perseus is focused on how to implement existing recommendations and emerging standards by providing automated access to the raw data they need.

Q: What’s the plan?

A:

Our plan for 2025 is https://ib1.org/perseus/2025-plan

Our plan for 2024 was detailed at https://ib1.org/perseus/2024-plan

Our priorities for 2023 were to:

- Build a demonstrator of how this will work in practice

- Convene stakeholders to demonstrate that we can go far together

This is documented at https://ib1.org/perseus/2023-report

Year 1 (2023) was about co-design and the creation of a demonstrator. Subsequent years will expand the scope of primary data flow (e.g. other energy types, water, transport) and enable automated Scope 3 reporting, and will develop the full go-to-market plans with members. The detailed design of future years’ priorities will, by definition, be done in collaboration with members.

Future years will expand in scope and reach (e.g. beyond electricity, beyond the UK, and potentially beyond SMEs).

Q: What are the lessons from Open Banking and the national data strategy?

1. We are building on what works. Open Banking and Open Energy are existing programmes that enable the secure and trusted sharing of information between organisations, with the consent of the customer.

2. The programme is completely aligned with the UK Government’s Smart Data Council and the new UK Data Act (2025).

3. For more reflections on this approach, please see this article on ‘lessons learned‘ from the CMA’s former Head of Open Banking.

Q: Is your end goal more accurate carbon reporting?

A: While more accurate reporting is a product of Perseus, it is not its primary goal. With appropriate permission from SMEs, Perseus facilitates the onward sharing of derived carbon reporting data to banks. This second step in the data flow is crucial to unlocking affordable green finance for SMEs, which is required to fund action on decarbonisation. Perseus supports SMEs through a journey which starts with carbon reporting and moves towards a competitive, dynamic ecosystem empowering SMEs to identify, fund and implement personalised actions to decarbonise their business.

Q: Why 30-minute electricity consumption data?

A: The commercial user need of 30-minute electricity consumption data was determined collaboratively by members of AG1 in Phase 1 (2023), approved by the SG as outlined in this report and implemented in 2024. The decision was informed by the direction of travel in emissions reporting towards using accurate and granular consumption data, rather than estimates or billing data (e.g. PCAF Standard).

30-minute resolution data needs include:

- SME personalisation: empowering software solutions to make more granular recommendations for decarbonisation actions following carbon reporting processes, identifying what actions can be taken to reduce the emissions based on a business’ specific consumption profile. In future, Perseus will enable this granular consumption information to be combined with other relevant datasets such as building fabric, location, aspect, water consumption, etc.

- Accurate matching: enabling more accurate matching with grid and locational carbon intensity at specific times of day and night, accounting for potentially considerable fluctuation in emissions even over a 24-hour period.

- Risk reduction and assurable impact assessment: The above information granularity enables banks to more confidently ‘de-risk’ their lending to SMEs for the purpose of emissions-reduction interventions by providing benefits such as higher accuracy regarding pay-back periods, cost savings to the business, or other potential financial benefits tailored to specific business contexts, activities, and asset/service investments. Post-deployment of solutions can enhance monitoring, reporting and verification (MRV) of impacts.

Q: Will users pull smart meter data every 30 minutes?

A: No. Such demand is not a user need, would be unnecessarily costly, and could impact traffic on the Smart DCC communications network and related aggregators. The resolution of the reported data may be 30-minute resolution, but not its reporting frequency. Users will pull datasets at appropriate intervals for carbon recording (e.g. weekly, monthly or annually) as determined by the commercial user needs identified by the AGs. The chosen interval would not affect the granularity of the data, only the frequency with which it is delivered.

2. Time and money

Based on prior experience (e.g. Open Banking, Open Energy) we have modelled that this initiative will require £2-3M funding per annum for a minimum of three years to establish its foundations. Once the framework and enabling conditions have been created, substantial cost and friction will have been removed, and value unlocked. B4NZ and Icebreaker One are jointly developing the programme as non-profit actors. Sponsorship is open to any organisation. Costs are being distributed evenly between members based on organisational size. Please check the details on the current year plan and membership pages for details.

Q: Do we have to pay?

- If you are a commercial organisation, yes. If you are a non-commercial organisation, maybe.

Bankers for Net Zero and Icebreaker One are non-profit companies: they need to pay their teams to do the work. The tiered fee structure is based on the size and type of organisation. Trade Associations and related non-commercial organisations are encouraged to make a contribution but it is not a requirement. If you are a small or medium business, you can sign up online today.

Q. What will the money be used for?

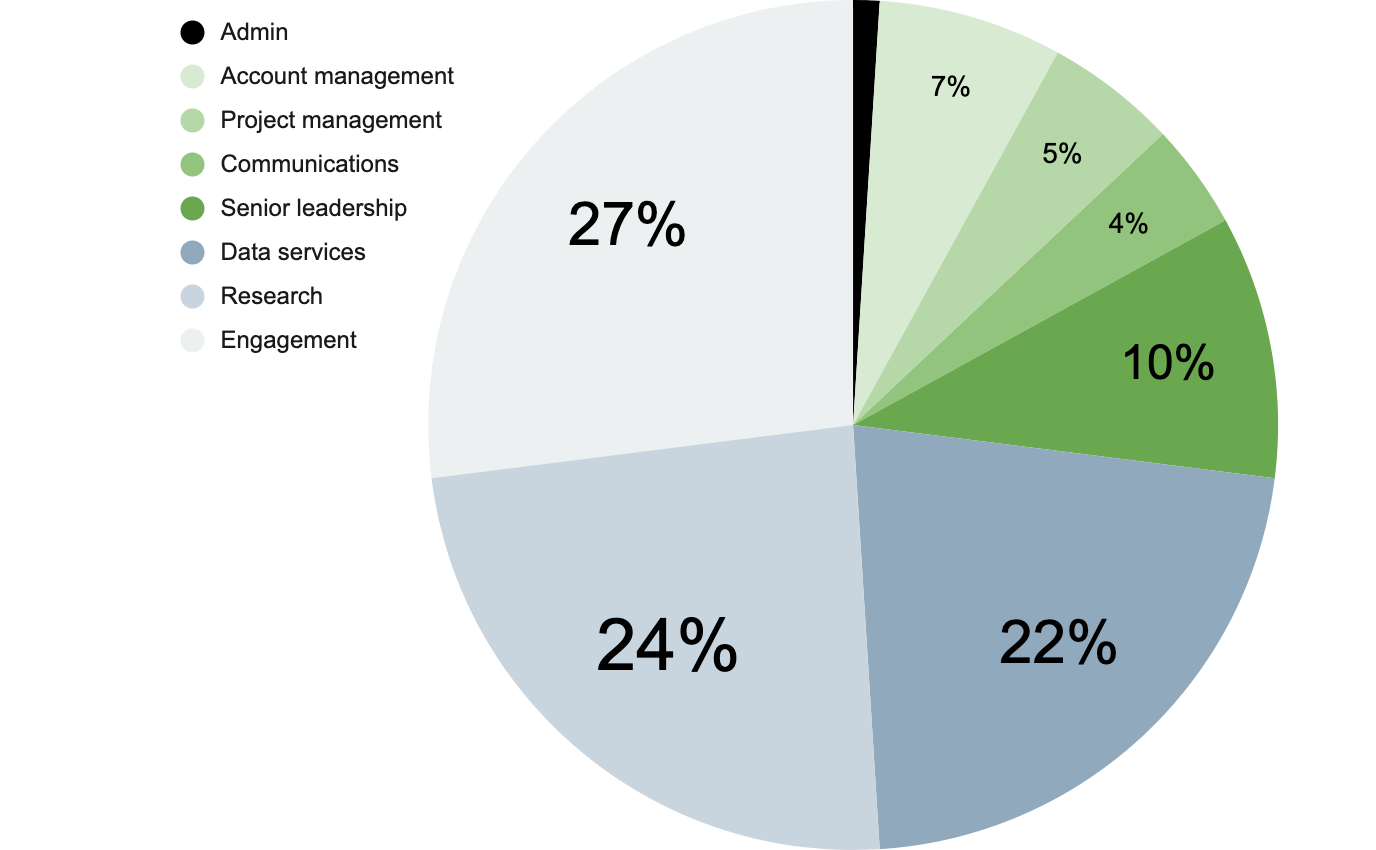

- Staffing and resources for operation and implementation, supporting fixed costs including communications and taking Perseus to events. Both delivery organisations are not for profit, limited by Guarantee companies.

- IB1 funds will be deployed as follows

Q. Can we pay in-kind only?

- If you are a commercial organisation, no.

Icebreaker One is providing the majority of the operational and implementation teams, with commercial partners providing the funds and industry guidance via Advisory Groups. This allows an experienced and cohesive team to lead on implementation.

Q: What’s the time commitment?

- Members do need to be able to provide some limited in-kind support to review documents. We have kept this to an absolute minimum (1-2 days per year to review/feedback/approve documents). We strongly encourage members to lean in as much as possible if they can.

Advisory Group members should commit about six (6) hours per month. This includes attending the 2-hour Advisory Group meetings. Domain experts will commit three (3) hours per month, including the Advisory Group meetings.

3. Business case

If organisations are not working towards assurable data flow for Net Zero, they will fall foul of greenwashing accusations. Regulation is also moving rapidly in this direction. A longer version of this is at https://ib1.org/perseus/business-case-2023

Q: Why should we fund this rather than just wait for everyone else to fund it and come in later?

If you are questioning the need to invest now in a collective action challenge for climate change and suggest waiting for others to fund it and come along later, here are some key points to consider:

- Urgency of Climate Change: Climate change is a pressing global challenge that requires immediate action. Waiting for others to address the issue may lead to irreversible environmental and social consequences. Investing now in collective action can help tackle climate change’s root causes and mitigate its impacts effectively.

- Multiplier Effect: When multiple stakeholders come together to invest in a collective action challenge, the impact is magnified. Collective efforts can lead to more significant results, as resources, expertise, and knowledge are pooled. Waiting for others to act might delay or weaken the effectiveness of the response.

- Leadership and Influence: By taking the initiative to invest in climate change challenges, you can demonstrate leadership and influence others to follow suit. Your actions can inspire and encourage others to contribute to the cause, creating a positive domino effect.

- Innovation and Learning: Early involvement in collective action allows for experimentation, learning, and innovative solutions. Waiting for others to act might limit opportunities for developing new approaches and technologies that could lead to more efficient and impactful outcomes.

- Risk Mitigation: Climate change poses significant risks to businesses, communities, and economies. Investing in collective action now can help mitigate those risks and ensure a more resilient future.

- Moral and Ethical Responsibility: Addressing climate change is not just a matter of convenience; it is a moral and ethical responsibility to protect the planet and future generations. Delaying action may exacerbate inequalities and harm vulnerable communities disproportionately.

- Policy and Regulatory Environment: Global efforts to combat climate change are likely to result in stricter policies and regulations in the future. Investing early can position organisations and individuals to comply with emerging standards and avoid potential penalties.

- Economic Opportunities: Investing in climate change solutions can create new economic opportunities, drive innovation, and promote sustainable business practices. It can lead to the development of green technologies and industries, contributing to long-term economic growth.

- Global Collaboration: Climate change is a collective challenge that requires collaboration among governments, businesses, civil society, and individuals. Investing now in collective action demonstrates a commitment to global cooperation and partnership.

- Time for Impact: Climate change requires long-term solutions, and the longer we wait, the more challenging and costly it becomes to address its effects. Acting now increases the likelihood of achieving meaningful and lasting impact.

In conclusion, investing now in a collective action challenge for climate change is not just about financing a project; it is about taking responsibility, demonstrating leadership, and working together to safeguard the planet’s future. Delaying action may jeopardise our ability to address climate change effectively and could result in missed opportunities for positive change. By acting now, you can contribute to a more sustainable, resilient, and equitable future for all.

Q: What’s the business case for a bank?

A: Perseus aims to unlock access to capital through better access to assurable data.

This can help banks to reduce their risks in lending to small and medium-sized enterprises (SMEs) by providing them with more reliable and trustworthy data on the sustainability performance of these businesses. Access to this data allows banks to better assess the risks associated with lending to these companies, which can potentially lead to lower default rates and higher returns, and create personalized lending recommendations for their customers.

Being able to offer bespoke incentives for SME customers to decarbonise can also help banks differentiate from competitors and build strong customer relationships. Additionally, Perseus can help banks to demonstrate their own sustainability commitments and meet regulatory requirements related to environmental, social, and governance (ESG) issues.

Q: What’s the business case for an energy company?

- Perseus will help energy companies support their customers to decarbonise, unlock funding, and reduce their administrative costs of sustainability reporting. Energy companies operate in a competitive environment where the ability to offer meaningful additional value and convenience to SME customers can help make a strong value proposition. As the energy sector becomes digital and more renewables come onstream, Perseus will help create material links between the funding of solutions and impact.

Further, there is a strong likelihood that enabling automated energy-based (Scope 2) emissions will be mandated. Energy companies will benefit from being prepared for this and shaping the nature of future regulation.

Q: What’s the business case for an SME?

- Perseus will massively reduce the burden associated with SMEs’ sustainability reporting while enabling financial incentives to report and reduce their emissions. Sustainability reporting can be a time-consuming and resource-intensive process. A low-effort, low-friction way to do this allows SMEs to focus on their core business. The assurable data flow can also unlock access to capital by letting lenders or investors link preferential terms to assurable sustainability data. Additionally, by participating in Perseus, SMEs can grow their reputation with potential partners, customers, and employees, and gain access to a network of organisations that are committed to sustainability and responsible investment, which can provide valuable connections and resources for future growth.

Q: What is the business case for 3rd parties?

(e.g. accountants, accountancy software firms, carbon accountants, auditors, consultants and advisors)

- Perseus offers a compelling business case for carbon accounting firms, carbon analytics software providers, accountancy firms, auditors, consultants and advisors.

By automating access to reliable and assurable data, Perseus can help these firms to offer new and bespoke services to their clients, streamline reporting processes, improve the quality of the data they work with and unlock access to assurance processes that don’t currently exist.

It will also help them build a reputation as a socially responsible company, enhance brand value, and create new business opportunities.

The continued drive to standardisation of sustainability reporting also makes it easier to compare the performance of different companies and identify areas for improvement. With a high likelihood that regulation around sustainability reporting will come into force, participating in Perseus also gives firms a valuable opportunity to engage with regulators and policymakers at an early stage, providing visibility of, and influence in, the details of these regulations.

Q: What’s the value case for the UK?

- The business case of Perseus for the UK is to support the country’s transition to a low-carbon economy and meet its net-zero emissions target by 2050. By unlocking access to capital through better access to assurable data, Perseus can help to unlock finance for the infrastructure and innovation needed to achieve this goal. In addition, the program can help to create new jobs and stimulate economic growth in the UK’s green economy. By developing pragmatic whole-of-market solutions to automate GHG reporting for every SME in the country, Perseus can also help to promote sustainability reporting and increase transparency in the UK’s financial system. Overall, Perseus can position the UK as a leader in green finance and sustainable business practices.

4. Who is involved?

Q: Who is on the Steering Group?

A: The Steering Group is designed to gather experts that can represent banking, ledger, energy and SME communities. The Steering Group defines and authorises the creation of Advisory Groups to help deliver the mission and its Goals. It will review the outputs from the AGs and sign-off on material direction and outputs.

Principal: Bankers for Net Zero

Co-chairs: British Business Bank, Icebreaker One

Steering Group members: British Chamber of Commerce, Confederation of British Industry, Energy UK, Federation of Small Business, ICAEW, Innovate Finance, Innovate UK, Institute of Directors, TheCity UK, The Department of Energy Security and Net Zero, The Lending Standards Board, UK Finance, Volans, We Mean Business Coalition

Observers: ACCA Global, International Chamber of Commerce, OECD, UNEP FI, World Energy Council, Dame Teresa Graham (independant)

Q: Who are Bankers for Net Zero (B4NZ)?

A: Bankers for Net Zero (B4NZ) convenes the UK country chapter of the Net Zero Banking Alliance (NZBA), which is one of the four main pillars of the Glasgow Financial Alliance for Net Zero (GFANZ).

Its focus is strategic policy alignment – by creating clarity on which areas of the net zero transition require policies which can optimise the contribution banks can make to the real economy, it enables both policymakers and banks to play their part in accelerating the transition to net zero.

Q: Who are Icebreaker One?

A: Icebreaker One is a UK-based independent, global non-profit that aims to connect private and public sector leaders to help reduce risk and grasp the opportunity to transform the climate crisis into economic innovation. Its mission is to make data work harder to deliver net zero, working across agriculture, energy, transport, water and the built world. It leads and/or supports market-scale, national and international data governance programmes including Open Energy, the Standard for Environment, Risk and Insurance (SERI), Mission Innovation, and Future of Sustainable Data Alliance. Its team was instrumental in the creation of the Open Banking Standard in the UK and other countries.

Steering Group Chairman

Icebreaker One founder and CEO, Gavin Starks, is co-chairing the Perseus Steering Group. He was appointed co-Chair of the Open Banking Standard by HMT in 2015 and helped to lead its 150-person, cross-industry team to deliver the initial Standard within three months, and continued engagement with the FCA and CMA to aid translation to implementation and lay the foundations for Open Finance. He aided both New Zealand and Canada in their design and implementation of Open Banking.

Over the last three years, Icebreaker One has led the creation of Open Energy (through a national, government-funded competitive process, co-funded by Government, industry and philanthropic funding) convening industry, regulators, trade associations and government to develop national energy data infrastructure. Starks co-Chairs the Open Energy Steering Group and the IB1 team created the Trust Framework to enable its implementation (based on their work in designing and implementing Open Banking). Funded via Ofwat, Icebreaker One is also working with the water sector to develop ‘Stream’, creating Steering and Advisory Groups, and operating its secretariat across multiple national companies across the sector. Gavin is a regular contributor to the UK’s national data strategy development work, via various government departments, and sits on the national Smart Data Council.

Q: Who is on the Advisory Groups and why?

A: The Advisory Groups’ purpose is to provide expert input to the programme, to address commercial, non-commercial and public needs. Participants represent a wide range of subject matter experts to meet the diverse needs of the project, and to ensure it is representative of stakeholders.

Members of Advisory Groups act as a representative of their industry and not of their individual company or body and contribute their expertise as impartially as possible. We are currently recruiting for the Advisory Groups here.

5. What about the data — trust, security and confidentiality?

Q: Is this a technology solution? We have our own application…

A: No. This approach does not replace anything that anyone has built: it is additive. There are two elements:

- The process of agreeing how to align on automating data flow;

- A Trust Framework (like Open Banking) that enables applications to connect.

Q: Does Icebreaker One, B4NZ or ‘perseus’ store or ‘see’ the data?

A: No. This process creates the ‘rails’ for secure, trusted and secure data flow, not data storage or analysis. The customer has control over their data sharing.

Q: How will this be enforced? Will it be regulated?

A: Enforcement can be implemented by commercial legal contracts. However, there is also scope for regulation to support adoption. The Department of Energy Security & Net Zero is on the Steering Group. One of the project’s Five advisory groups will explore possible policy interventions ranging from mandates for participation across the financial and energy sectors to addressing protections for the usage of data (e.g. limiting use of SME data to the use case of reporting). We are also in conversation with regulators, including through the Smart Data Council, of which Icebreaker One is a Council Member.

Q: Won’t banks use this data to penalise SMEs?

A: Fears that the emissions data shared by SMEs may have negative consequences can be addressed in various ways, and the project will work with sector representatives to ensure that the carrot, rather than the stick, is the main driver for engagement. At the same time, the ultimate goal is to reward and encourage decarbonisation to help the whole economy reach Net Zero. SMEs with concerns around this would benefit from contributing to the programme to ensure that the developed solutions address their concerns. There are ways to mitigate the risk to underperforming SMEs – e.g. leniency periods between initial reporting and banks including reporting in their incentives/decision making or banks incentivising changes in emissions, irrespective of the initial level.

Q: What about artificial intelligence (AI), machine learning (ML) and related technologies?

- Access to trusted data is one of the enablers of the ai revolution. Initiatives such as Perseus are trying to tackle solutions to this head-on, to help deliver our Net Zero targets.

- The UK DPDI (‘Data’) Bill references that a Trust Framework could help to establish trust in AI systems by providing a set of standards and guidelines for their development and deployment. It could also help to ensure that AI systems are transparent, accountable, and fair.

More broadly, regulation may also mean that organisations may have no choice but to allow some data sharing. In this case, it is in their interest to have early awareness of, and a say in, the details of these regulations so they can be well prepared. This can also inform government and regulation through ‘AG5: Policy’.

Back to Perseus home page

Please contact us at perseus@ib1.org if you would like to discuss anything.